3D-Printed Coral Reefs: Can We Engineer Marine Recovery?

TL;DR: Electric aviation is advancing with battery breakthroughs and certified aircraft already flying, but scaling to commercial airliners faces stubborn physics limits. The next five years will determine if it transforms regional travel or remains a niche technology.

By 2035, electric aircraft could be as common at regional airports as hybrid cars are on highways today. That's not science fiction - it's the timeline aviation engineers and policymakers are working toward. But whether that future arrives on schedule depends on solving one deceptively simple problem: making batteries powerful enough to lift thousands of pounds into the sky, and light enough not to crash coming down.

Aviation accounts for roughly 2.5% of global CO₂ emissions, a figure projected to rise as air travel rebounds and expands. The pressure to decarbonize has never been greater, and electric propulsion offers a tantalizing solution. Yet critics argue that electric planes remain impractical for heavier aircraft like commercial airliners, pointing to fundamental energy density limitations that no amount of innovation seems ready to overcome.

The truth lies somewhere between utopian promise and engineering reality. Electric aviation isn't one technology but a spectrum of solutions - from two-seat trainers already certified and flying, to ambitious prototypes aiming for regional routes, to hydrogen-electric hybrids that may redefine what "electric" even means at altitude.

Energy density is everything in aviation. Jet fuel packs about 12,000 watt-hours per kilogram. Today's lithium-ion batteries? Barely 250 Wh/kg. That gap explains why your laptop doesn't need refueling but a 737 does.

Yet Amprius has achieved 450 Wh/kg in its silicon-nanowire lithium-ion cells - nearly double the industry standard. Even more impressive, their 400 Wh/kg system can charge to 80% in just six minutes using ultra-fast 10C charging. For operators of electric vertical takeoff and landing (eVTOL) aircraft, that means turnaround times approaching those of conventional helicopters.

Solid-state batteries represent the next leap. Belgium's Solithor is developing cells with 325-350 Wh/kg energy density, and early tests show they can handle over 500 full charge cycles with less than 7% capacity loss. More importantly, solid-state designs replace flammable liquid electrolytes with stable solid materials, slashing ignition probability from 10% (for lithium-ion) to just 1%.

Then there's Wright Electric's moonshot: batteries delivering 1,000 Wh/kg - a threefold increase over current aviation batteries. If they succeed, regional airliners carrying 50-100 passengers on routes up to 500 miles become economically viable. That's the sweet spot where electric aviation could genuinely disrupt conventional turboprops.

But here's the catch: solid-state batteries currently cost $400-800 per kilowatt-hour, compared to $100-150 for lithium-ion. Manufacturing yields hover around 50-60%, versus 90% for mature lithium-ion production. Scaling up will require not just better chemistry but entirely new production lines.

While headlines chase future promises, Pipistrel's Velis Electro has been the world's only type-certified electric aircraft since 2020. It's a two-seat trainer with a range of about 50 minutes plus reserves - perfect for flight schools where students typically log circuits lasting 20-30 minutes. Operating costs drop dramatically: electricity replaces avgas, and electric motors require far less maintenance than piston engines.

The Beta CX300 Alia, a cargo-focused electric CTOL (conventional takeoff and landing) aircraft, recently completed a grand tour of European airports. Its modular battery system can be swapped in minutes, sidestepping charging delays. Beta's strategy targets cargo and medical transport - missions where speed matters less than reliability and operating cost.

Harbour Air, a Canadian seaplane operator, has been testing electric conversions of its DHC-2 Beaver floatplanes. The eBeaver prototype flew successfully in 2019, proving the concept works for short coastal routes. Commercial service, however, remains grounded by certification hurdles and battery weight constraints.

Even more radical is the Electra STOL aircraft, a hybrid-electric design using distributed propulsion - eight small motors across the wing - to generate massive lift at low speeds. By taking off and landing in less than 150 feet, it could operate from downtown helipads or rural airstrips, bypassing congested airports entirely. That's not just electrification; it's a reimagining of where and how we fly.

Building electric planes is only half the challenge. They need somewhere to charge.

Germany's Hof-Plauen Airport is installing a network of fast chargers: 150kW CCS2+ plugs for rapid charging, 22kW Type 2 plugs for overnight sessions, and DC adapters for experimental aircraft. The Bavarian government is funding similar infrastructure across five regional airports, creating an electric corridor through southern Germany.

In the U.S., the story is more fragmented. Multiple stakeholders - including the FAA, EASA, GAMA, and NBAA - are collaborating on standards, but no universal charging protocol exists yet. That's a problem because aircraft manufacturers can't finalize designs until they know what plugs and voltages airports will support.

Munster/Osnabrück Airport is hedging its bets by building a 70-hectare solar farm to generate green electricity from 2027, paired with mobile chargers that can be repositioned as demand shifts. It's a pragmatic approach: generate the power on-site, stay flexible on delivery.

But charging infrastructure is expensive. A single 150kW fast charger costs $50,000-$100,000 installed. Multiply that across thousands of airports, and the investment required starts looking like the early days of jet fuel distribution - except this time, there's no existing revenue stream to justify it. Airports are waiting for aircraft; manufacturers are waiting for chargers. Someone has to blink first.

Electric aviation's environmental promise is real but nuanced. Yes, battery-powered planes produce zero emissions in flight. Yet battery production is energy-intensive, involving mining lithium, cobalt, and rare earth elements under conditions that often raise ethical and ecological concerns. A lifecycle analysis by sustainability researchers found that electric aircraft only achieve net carbon reductions if the electricity grid itself is renewable - a condition not yet met in most regions.

Then there's the question of scale. Critics like Rodney McInnis argue that electric propulsion works fine for ultralight aircraft but will never be physically practical for airliners. The energy density gap is just too vast. Jet fuel's 12,000 Wh/kg isn't just a benchmark; it's a physics problem that chemistry alone may never solve.

That's why hydrogen-electric hybrids are gaining traction. Hydrogen fuel cells generate electricity on demand, sidestepping battery weight while producing only water vapor as exhaust. Airbus's ZEROe program is developing hydrogen-powered regional jets for service by the mid-2030s, using 3D-printed heat exchangers to manage the cryogenic fuel's extreme temperatures.

The catch? Hydrogen requires entirely new fuel handling systems, airport infrastructure, and safety protocols. It's not an incremental change; it's a wholesale reinvention of aviation's supply chain.

Certification is where good ideas go to wait. The FAA and EASA have established pathways for electric propulsion, but the process remains glacial. Pipistrel's Velis Electro took years to certify because existing regulations were written for combustion engines and needed extensive adaptation.

Battery safety standards present unique challenges. Lithium-ion cells can experience thermal runaway - a chain reaction where one failing cell ignites its neighbors. Aviation regulators demand containment systems that prevent fires from spreading, adding weight and complexity. Solid-state batteries' lower ignition risk could streamline certification, but they're still too new to have a regulatory framework.

Then there's pilot training. Electric motors deliver instant torque, changing how aircraft handle. Regenerative braking during descent is possible but requires new procedures. The FAA is fast-tracking air taxi rules for urban eVTOLs, but critics worry that speed is compromising thoroughness.

Noise certification offers a rare bright spot. Electric motors are dramatically quieter than combustion engines, potentially opening airports to night operations currently banned due to noise restrictions. That's a genuine operational advantage that could accelerate adoption in noise-sensitive urban areas.

Operating an electric trainer like the Velis Electro costs about $50 per flight hour in electricity and maintenance, compared to $150+ for a conventional piston-powered trainer. Flight schools love those numbers. But upfront costs tell a different story: electric aircraft cost 30-50% more to purchase, and batteries need replacement every 1,500-2,000 cycles.

For airlines, the calculus is even trickier. Electric aircraft promise lower operating costs but can't yet match the range or payload of turboprops. A conventional ATR 72 carries 70 passengers 900 miles; proposed electric competitors might manage 50 passengers over 300 miles. That's not a replacement; it's a niche product.

Cargo operators see more promise. Medical transport and express delivery value speed and reliability over passenger count. Electric aircraft could dominate time-sensitive short-haul routes, especially if battery swapping eliminates charging delays.

Investment is pouring in regardless. Chinese motor manufacturers are ramping up production of high-power-density electric motors specifically for aviation, anticipating a market boom. Rare earth magnet production has shifted to support electric propulsion, with new U.S. facilities aiming to reduce dependence on Chinese supply chains.

But here's the reality: electric aviation won't be profitable until battery costs drop below $100 per kWh and energy density exceeds 500 Wh/kg. We're not there yet. The question is whether investors have the patience to wait.

The next five years will determine whether electric aviation becomes mainstream or remains a boutique technology for niche applications.

Certification milestones are critical. If half a dozen electric aircraft models achieve type certification by 2028, momentum will build. If delays persist, capital will flow elsewhere.

Battery breakthroughs could change everything overnight. Wright Electric's 1,000 Wh/kg target isn't guaranteed, but if achieved, it would unlock regional airline electrification. Even incremental gains - say, 600 Wh/kg by 2030 - would expand the viable range envelope significantly.

Infrastructure investment will accelerate once a few airports demonstrate profitability. RMI's analysis suggests that airports serving electric aircraft could attract new tenants - flight schools, air taxi operators, cargo services - creating revenue streams that justify charger installations.

Hydrogen-electric hybrids might leapfrog pure battery solutions for larger aircraft. Airbus's ZEROe timeline targets 2035 for entry into service, which could reset expectations about what "electric" aviation actually means.

Or none of this happens. Battery improvements plateau. Certification drags on. Infrastructure investment stalls. And electric aviation remains forever five years away - a perpetual promise never quite delivered.

Electric aviation isn't just about swapping engines. It's about rethinking where we fly, how often, and why.

Distributed electric propulsion enables short takeoff and landing (STOL) aircraft that could operate from downtown vertiports, suburban parking lots, or rural airstrips. That's not incremental improvement; it's a geographic redistribution of air travel away from hub-and-spoke networks toward point-to-point connections.

Quiet electric motors could make night flights socially acceptable in urban areas currently off-limits due to noise ordinances. Imagine red-eye cargo flights that don't wake neighborhoods, or early morning commuter hops that respect residential zones.

Reduced maintenance needs - electric motors have far fewer moving parts than turbines - could enable more frequent flights at lower cost. Instead of three daily flights to a regional destination, why not ten?

But these possibilities depend on technologies that don't quite exist yet, infrastructure not yet funded, and regulations still being written. The gap between vision and reality remains stubbornly wide.

The answer is: some already have. Pipistrel's Velis Electro is training pilots today. Beta's cargo demonstrators are proving the concept works. eVTOL prototypes are logging test hours across multiple continents.

But can electric aviation scale? That's the trillion-dollar question.

If battery energy density reaches 600-1,000 Wh/kg, if charging infrastructure spreads as fast as EV chargers have, if certification keeps pace with technology, if investors stay patient through the inevitable setbacks - then yes, electric planes could transform regional aviation within a generation.

If any of those "ifs" fail, electric aviation might remain a marginal curiosity, forever overshadowed by conventional turboprops and jets that just work, right now, with infrastructure already in place.

The race to sustainable flight isn't about a single breakthrough. It's about a hundred incremental improvements happening simultaneously across batteries, motors, infrastructure, regulation, and business models. Some will succeed; others will sputter. Whether the winners outpace the losers fast enough to matter is the question keeping aviation engineers up at night.

What's certain is that aviation must decarbonize. The only real debate is whether electricity leads the way, or whether hydrogen, sustainable aviation fuels, or some yet-unimagined technology proves to be the path forward.

Electric planes can take off. Whether they can land a sustainable aviation future depends on what happens next.

Ahuna Mons on dwarf planet Ceres is the solar system's only confirmed cryovolcano in the asteroid belt - a mountain made of ice and salt that erupted relatively recently. The discovery reveals that small worlds can retain subsurface oceans and geological activity far longer than expected, expanding the range of potentially habitable environments in our solar system.

Scientists discovered 24-hour protein rhythms in cells without DNA, revealing an ancient timekeeping mechanism that predates gene-based clocks by billions of years and exists across all life.

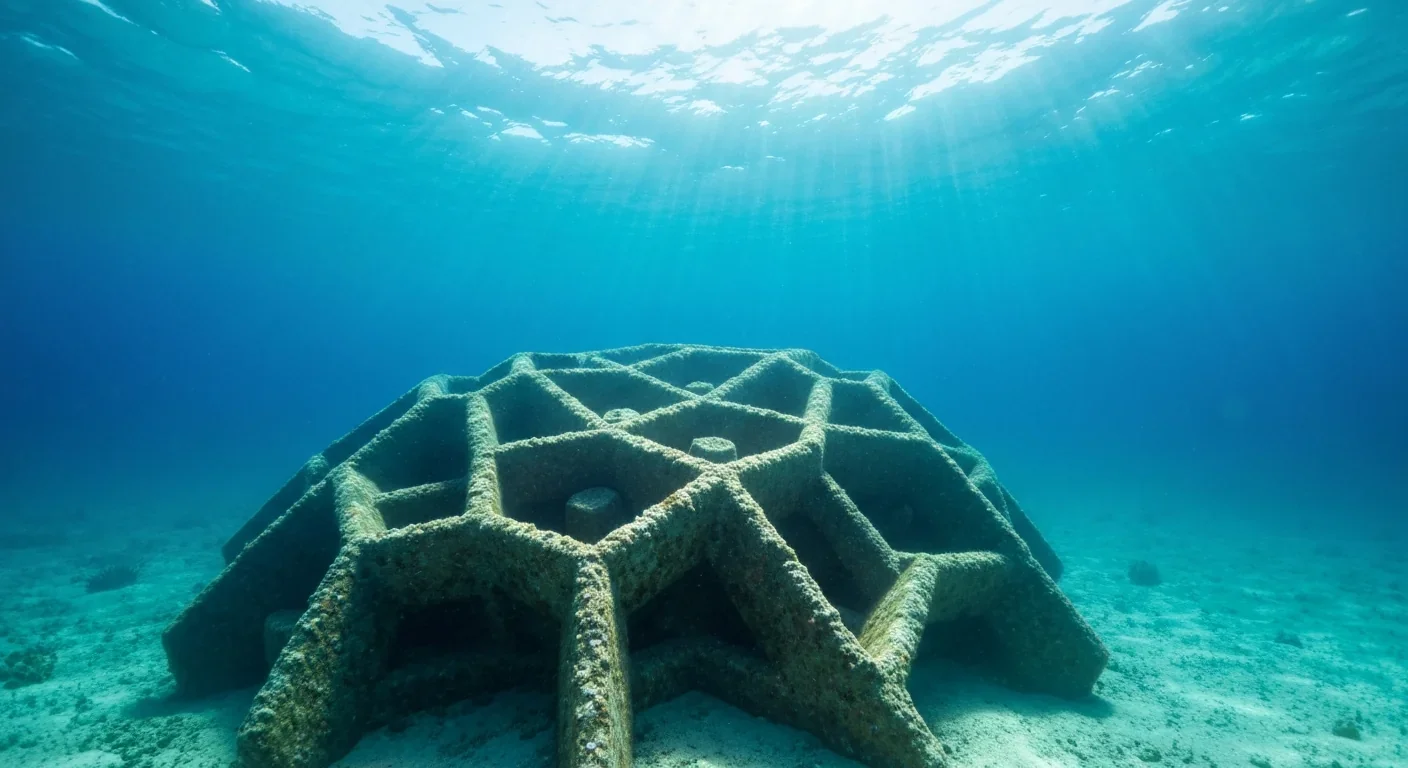

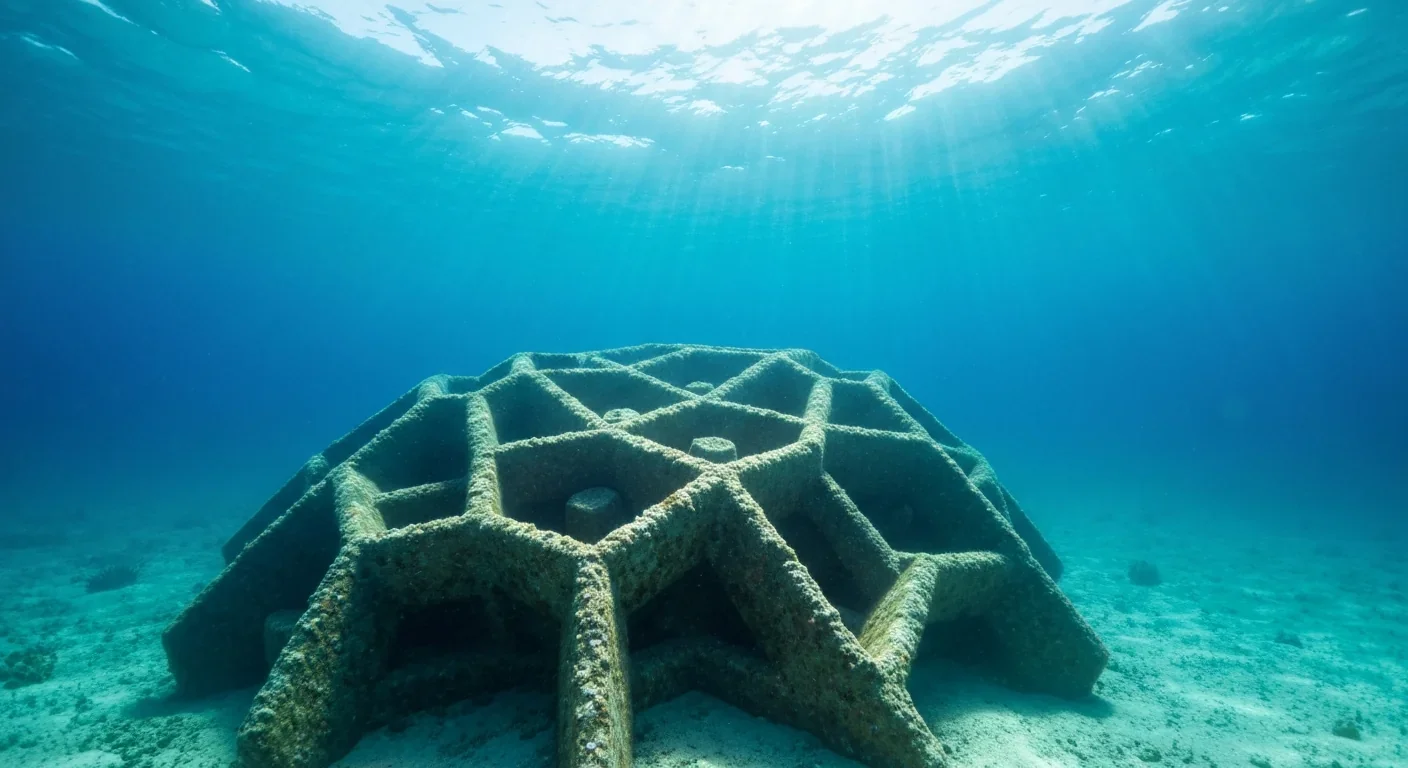

3D-printed coral reefs are being engineered with precise surface textures, material chemistry, and geometric complexity to optimize coral larvae settlement. While early projects show promise - with some designs achieving 80x higher settlement rates - scalability, cost, and the overriding challenge of climate change remain critical obstacles.

The minimal group paradigm shows humans discriminate based on meaningless group labels - like coin flips or shirt colors - revealing that tribalism is hardwired into our brains. Understanding this automatic bias is the first step toward managing it.

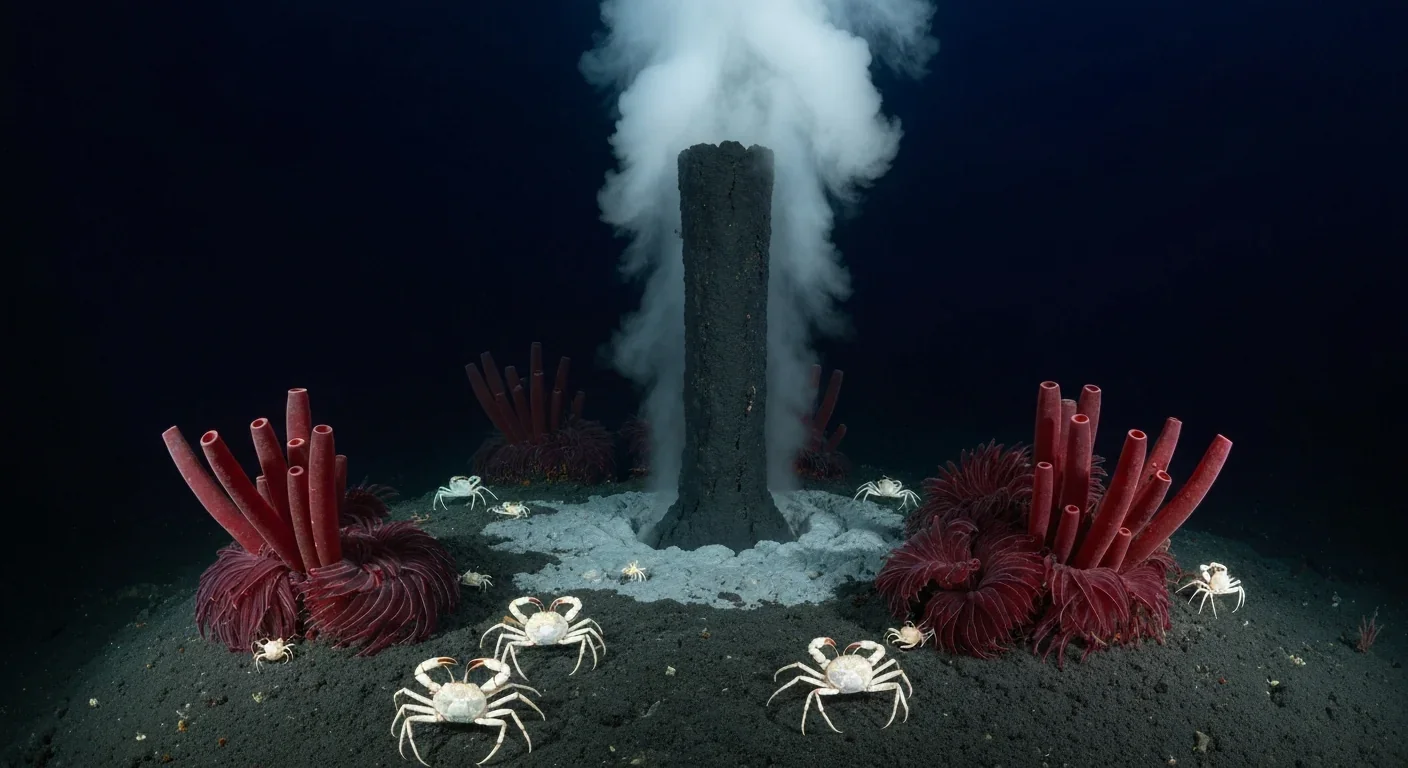

In 1977, scientists discovered thriving ecosystems around underwater volcanic vents powered by chemistry, not sunlight. These alien worlds host bizarre creatures and heat-loving microbes, revolutionizing our understanding of where life can exist on Earth and beyond.

Automated systems in housing - mortgage lending, tenant screening, appraisals, and insurance - systematically discriminate against communities of color by using proxy variables like ZIP codes and credit scores that encode historical racism. While the Fair Housing Act outlawed explicit redlining decades ago, machine learning models trained on biased data reproduce the same patterns at scale. Solutions exist - algorithmic auditing, fairness-aware design, regulatory reform - but require prioritizing equ...

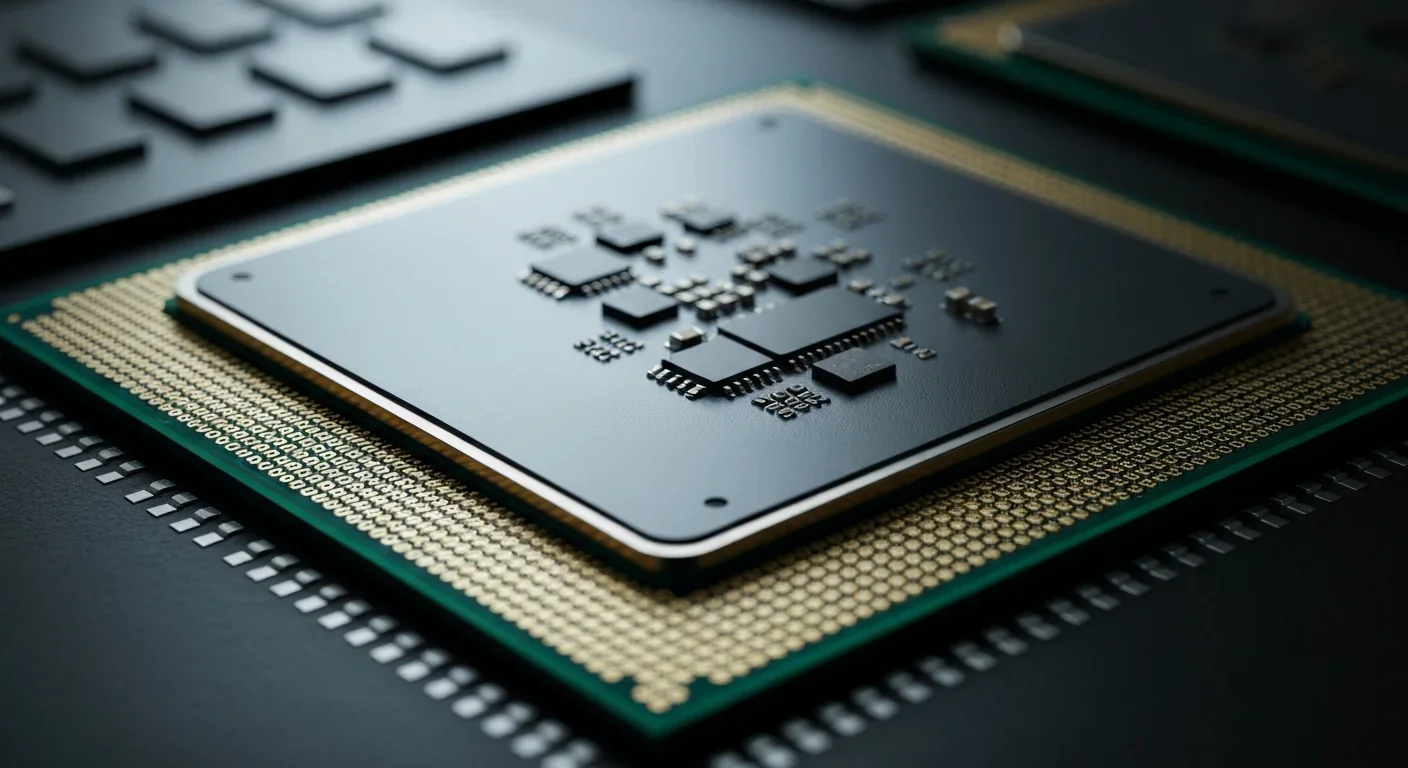

Cache coherence protocols like MESI and MOESI coordinate billions of operations per second to ensure data consistency across multi-core processors. Understanding these invisible hardware mechanisms helps developers write faster parallel code and avoid performance pitfalls.