3D-Printed Coral Reefs: Can We Engineer Marine Recovery?

TL;DR: By 2027, EU law mandates digital passports for all EV and industrial batteries, revealing lifecycle data from mining to recycling. This transparency revolution will reshape global supply chains, drive recycling innovation, and create accountability for ethical sourcing.

By February 18, 2027, every electric vehicle battery and industrial battery over 2 kWh sold in the European Union will carry something unprecedented: a digital passport revealing its entire life story. Where its cobalt came from. How much carbon its manufacturing released. Whether child labor touched any part of its supply chain. This isn't a voluntary sustainability initiative that companies can greenwash their way around. It's binding EU law, and it's about to reshape how batteries are made, used, and recycled worldwide.

The EU Battery Regulation that mandates these digital passports represents one of the most ambitious industrial transparency frameworks ever attempted. While Europe is leading the charge, the ripple effects will reach mining operations in the Democratic Republic of Congo, manufacturing facilities in China, recycling centers in North America, and every automotive boardroom globally. Within two years, batteries will become some of the most traceable industrial products ever created.

Think of a battery passport as a comprehensive digital dossier that follows a battery from raw material extraction through decades of use and eventual recycling. Each passport contains dozens of data points organized into three access levels: public information anyone can view, restricted technical data for repair shops and recyclers, and regulatory details only government agencies can access.

The implementation relies on three core technologies: QR codes physically attached to batteries, blockchain distributed ledgers that create immutable records, and cloud databases that store the detailed specifications. When you scan the QR code on an EV battery with your smartphone, you'll access public data like carbon footprint and material sourcing. Repair technicians scanning the same code get additional information about battery health, safety protocols, and service history.

KULR Technology recently launched one of the first blockchain systems specifically for battery supply chains, minting each battery cell's metadata as a non-fungible token. As Michael Mo, KULR's CEO, explains: "We are leveraging proven blockchain technologies to deliver commercial applications that provide our customers with a trustworthy data source and improved operational efficiency."

Circulor, a materials traceability leader, expanded its Hyperledger Fabric-based solution to underpin digital battery passports, demonstrating how enterprise blockchain can balance transparency with data confidentiality. The technology must walk a fine line between providing visibility for regulators and consumers while protecting manufacturers' proprietary information about battery chemistry and production processes.

The BASE project, funded by the EU's Horizon Europe program, is developing the trusted interoperable framework that will become the technical backbone of the system. Their work goes beyond compliance, creating AI-driven insights and supporting the "4R" strategies: Reduce, Repair, Reuse, and Recycle.

Battery passports organize information into three tiers: public data (carbon footprint, ethical sourcing), restricted information (repair and recycling instructions), and regulatory data (compliance reports accessible only to government agencies).

The regulation specifies exactly what information each passport must include, leaving little room for creative interpretation. Carbon footprint data must cover every stage from raw material extraction through production and transport. For an EV battery, that means disclosing emissions from cobalt mining in Africa, lithium extraction in South America, cell manufacturing in Asia, and pack assembly in Europe.

Material composition gets equally granular treatment. Passports must list percentages of critical raw materials including cobalt, lithium, nickel, and increasingly important minerals like manganese and graphite. Supply chain data must reveal the origin of these materials and demonstrate compliance with due diligence obligations, particularly regarding human rights and environmental standards.

Performance indicators form the third pillar of required data. Technical specifications include capacity, durability ratings, efficiency metrics, and state of health. This information serves multiple purposes: helping consumers compare products, enabling repair shops to diagnose issues, and allowing recyclers to determine the most effective processing methods.

The passport must also document recycled content, showing what percentage of materials came from recovered batteries rather than virgin extraction. Collection rates, recycling potential, and end-of-life instructions round out the required data set. Every piece of information must remain accessible for at least ten years after a battery leaves the market.

The global battery industry is experiencing explosive growth, with the lithium-ion battery recycling market alone projected to expand dramatically as electric vehicle adoption accelerates. Battery passports will fundamentally reshape the economics of this ecosystem, creating both costs and opportunities.

Compliance costs hit manufacturers first. Companies must invest in robust data collection systems, engage suppliers early to capture upstream information, and implement digital platforms to manage reporting complexity. BASF's Lydie Derebreu identified four key concerns that could affect corporate adoption: ensuring data confidentiality, leveraging existing standards to ease implementation, helping companies show improvement over time, and aligning adoption with customer incentives.

For smaller manufacturers, these costs pose significant challenges. Small and medium enterprises often lack resources to build advanced traceability systems independently. Without harmonized solutions, the industry risks fragmentation, duplicated efforts, and market consolidation as only the largest players can afford comprehensive compliance.

"The EU regulation has been a big driver of interest because companies must do it, but the entry points are very apparent in other regions as well."

- Inga Petersen, Executive Director, Global Battery Alliance

But the regulation also creates new business opportunities. The circular battery economy is projected to reach $77.84 billion by 2032, driven partly by the transparency that passports enable. The second-life EV battery market could hit $12.42 billion by 2034 as passport data makes it easier to evaluate batteries for reuse in stationary storage applications.

Recycling economics improve substantially when processors know exactly what's inside each battery. Detailed chemical information helps facilities manage safety risks and optimize recovery of valuable materials. Companies specializing in second-life batteries gain precise insights into battery health and remaining lifespan, reducing risk and improving ROI calculations.

Early movers can capture competitive advantages. Panasonic's Janet Lin identified three main benefits during a Climate Week NYC panel: comparability across battery products, credibility for environmentally responsible offerings, and efficiency in compliance and reporting. Companies that establish leadership in transparency may gain easier access to public contracts and stronger relationships with sustainability-focused investors.

Battery supply chains are among the most complex in modern industry, spanning dozens of countries and hundreds of suppliers. Passports force unprecedented transparency through these multi-tiered networks, creating ripple effects that extend far beyond Europe's borders.

Non-EU manufacturers supplying European markets must meet the same passport standards as domestic producers. This requirement effectively exports EU regulations globally. A battery plant in South Korea, China, or the United States must collect and report the same detailed data if it wants to sell into Europe's massive automotive and energy storage markets.

Chinese manufacturers face particular challenges. Many are already participating in pilot projects, but concerns remain about regulatory alignment, national data policies, and intellectual property exposure. The requirement to disclose detailed supply chain information conflicts with some Chinese manufacturers' traditional approaches to proprietary information.

Mining operations at the beginning of supply chains feel the pressure most acutely. Cobalt mines in the Democratic Republic of Congo, where child labor and human rights violations have plagued the industry, must now provide verifiable documentation of ethical practices. Lithium extraction operations in South America face scrutiny over water usage and indigenous rights.

Minespider's partnership with Rare Earth Ventures to boost traceability in Australia's critical minerals supply chains demonstrates how passport requirements are reshaping mining sector operations. Australia, with its strong regulatory environment and advanced mining practices, positions itself as a preferred source of "passport-ready" materials.

The requirement creates natural advantages for companies with vertically integrated supply chains or strong supplier relationships. Automotive manufacturers that work directly with battery suppliers find compliance easier than those sourcing through multiple intermediaries. This dynamic may accelerate vertical integration trends already visible in the industry.

Third-party verification becomes crucial. The BATRAW pilot project revealed that independent audits are essential for verifying data accuracy, particularly regarding ethical sourcing and carbon reporting. A cottage industry of certification bodies and auditing firms is emerging to meet this need.

By 2031, new batteries must contain minimum recycled content: 16% cobalt, 85% lead, 6% lithium, and 6% nickel. These requirements increase to 26% cobalt and 12% lithium by 2036.

Theory meets reality in the messy details of data collection across global supply chains. The BASE project's experience highlights practical hurdles that go beyond technology.

Data quality poses the first major challenge. Supply chains currently lack standardized systems for measuring and reporting many required metrics. Carbon footprint calculations vary significantly depending on methodology, making apples-to-apples comparisons difficult. A cathode manufacturer in one country might calculate emissions one way, while a cell assembler elsewhere uses completely different boundaries and factors.

Getting suppliers to share information proves equally difficult. Many smaller suppliers view detailed data about their processes as proprietary information they're reluctant to disclose. Some lack the technical capability to collect and report data in the required formats. Building data collection infrastructure throughout multi-tiered supply chains requires coordination, investment, and often contractual pressure from large buyers.

Cybersecurity and data integrity concerns complicate matters further. Battery passports will contain competitively sensitive information about manufacturing processes, material sources, and business relationships. The systems storing this data become attractive targets for industrial espionage. Blockchain technology provides some protection through its distributed, immutable nature, but implementation must still address vulnerabilities at data entry points and access interfaces.

Maintaining data across decades presents technical challenges. A battery installed in a 2027 EV might operate for ten years in the vehicle, then spend another decade in second-life stationary storage, before finally entering recycling around 2047. The passport must remain accessible and updatable throughout this 20-year journey, through changes in ownership, technology platforms, and potentially legal jurisdictions.

Companies must balance transparency with business confidentiality. While regulators and consumers need certain information, manufacturers legitimately want to protect trade secrets about battery chemistry and production processes. The three-tier access system (public, restricted, regulatory) attempts to address this, but drawing appropriate lines remains contentious.

Battery passports have potential to transform recycling from a marginal operation into a core pillar of the battery industry. The EU aims to achieve specific recycling efficiency targets: 90% recovery of cobalt, copper, and nickel, and 70% recovery of lithium by 2030.

Current recycling rates fall far short of these goals, partly because recyclers often don't know precisely what's inside batteries they're processing. Battery chemistries vary significantly between manufacturers and models. An NMC battery (nickel-manganese-cobalt) requires different processing than an LFP battery (lithium-iron-phosphate). Older designs mix materials in ways that complicate separation and recovery.

Detailed passport data eliminates this uncertainty. Recyclers receive complete information about material composition before beginning processing. They can sort incoming batteries by chemistry and condition, optimizing recovery processes for each type. Safety protocols become more precise when facilities know exact chemical compositions and potential hazards.

The economic case for recycling strengthens considerably. Critical minerals like lithium, cobalt, and nickel represent significant value that current low recycling rates leave untapped. As passport requirements drive more batteries into proper recycling channels and improve recovery efficiency, recycled materials become increasingly competitive with virgin extraction.

"We are leveraging proven blockchain technologies to deliver commercial applications that provide our customers with a trustworthy data source and improved operational efficiency."

- Michael Mo, CEO, KULR Technology

Closed-loop recycling becomes feasible at scale. Battery manufacturers can track recycled content from specific batteries back into new production, creating verifiable circular supply chains. This traceability helps companies meet the regulation's requirements for minimum recycled content in new batteries: 16% cobalt, 85% lead, 6% lithium, and 6% nickel in new batteries by 2031, increasing to 26% cobalt and 12% lithium by 2036.

Second-life applications get a significant boost from passport data. EV batteries typically retain 70-80% of their original capacity when retired from vehicles. With detailed information about battery history, health, and remaining capacity, companies can confidently deploy these batteries in less demanding stationary storage applications. The passport essentially provides a battery's medical history, allowing accurate prognosis of remaining useful life.

While the EU leads on regulatory requirements, the Global Battery Alliance is working to create international standards that could harmonize passport systems globally. The GBA's recent partnership with the International Trade Centre aims to develop digital infrastructure and streamline battery certification that works across borders.

The Battery Benchmarks framework launched by the GBA assesses batteries against globally defined sustainability standards. These benchmarks form the foundation for certifications under the Battery Passport initiative now entering its prototyping phase, with the final product expected by 2027 to align with EU requirements.

As GBA executive director Inga Petersen explains, different regions have different priorities. While sustainability requirements drive adoption in Europe, in North America the focus falls more on transparency for battery recycling content, which carries economic value. "The EU regulation has been a big driver of interest because companies must do it, but the entry points are very apparent in other regions as well," Petersen noted.

Industry pilots with major players like Tesla, Panasonic, CATL, and LG Energy Solution have confirmed that battery passports can effectively communicate environmental and ethical information. These early implementations provide valuable lessons about what works and what needs refinement.

Regional fragmentation remains a risk. If different jurisdictions implement incompatible passport systems, batteries might need multiple passports to access different markets. This would increase costs and complexity without adding commensurate benefits. The push for international standards aims to prevent this scenario.

Volvo launched one of the first commercial battery passports with its EX90 SUV in 2024, more than two years before the mandate takes effect. The passport clearly outlines raw material origins, components, recycled content, and the battery's CO2 footprint. This early move positions Volvo as a leader in transparency and provides the company with valuable experience ahead of the 2027 deadline.

Panasonic has contributed to the Battery Passport program, piloting track-and-trace tools with key customers. The company produces batteries for passenger, commercial, and autonomous EVs, making it a critical player in passport implementation. Senior vice president Janet Lin has called for clearer guidance on onboarding suppliers and customers, noting the significant capital and human resources required.

Powin partnered with Circulor to implement traceable battery passports for energy storage systems. This collaboration demonstrates that passport technology applies beyond automotive applications to the rapidly growing stationary storage market.

BASF joined the initiative despite concerns about data confidentiality, standardization, showing improvement over time, and customer incentives. Lydie Derebreu emphasized that the program "sets the bar higher" for the entire battery value chain and catalyzes innovation by encouraging companies to improve sustainability performance.

Battery technology providers are also getting involved. Dassault Systèmes offers battery passport solutions integrated with their 3DEXPERIENCE platform, targeting companies that want comprehensive digital twin capabilities alongside passport compliance.

The European Commission estimates that demand for lithium batteries alone will grow by more than ten times by 2030, making sustainability frameworks like passports essential for responsible scaling.

February 18, 2027 will mark a clear before-and-after moment for the battery industry. On that date, digital passports become mandatory for industrial batteries over 2 kWh, EV batteries, and light means of transport batteries entering the EU market. Non-compliant batteries cannot be sold, creating significant financial risks for unprepared companies.

The timeline leaves manufacturers just over one year to finalize systems, test data flows, and ensure supplier compliance. For companies still in early planning stages, time is running short. Setting up robust data collection systems, engaging suppliers, and evaluating digital solutions takes months or years, not weeks.

Missing data or failing to comply could result in significant fines or complete bans on battery sales within the EU. Given that Europe represents one of the world's largest markets for electric vehicles and energy storage, exclusion would devastate any battery manufacturer's business prospects.

Companies face a strategic choice: view passports as merely a compliance burden to minimize, or embrace them as an opportunity to differentiate on sustainability and transparency. Early movers that help set standards and build credibility may gain competitive advantages in accessing public contracts, securing investment, and building brand value with increasingly sustainability-conscious consumers.

The regulation also includes a phase-in for other requirements. Carbon footprint declarations became mandatory for EV batteries in February 2025, providing a preview of coming transparency requirements. Recycled material content minimums take effect in August 2028, creating additional incentives for building robust recycling systems.

Due diligence obligations for battery supply chains were postponed to August 2027 as part of the EU's Omnibus IV simplification package, giving companies a few extra months to build ethical sourcing verification systems. However, this represents only a brief reprieve, not a fundamental change in requirements.

Battery passports represent more than regulatory compliance. They embody a fundamental shift in how we think about industrial products, supply chain accountability, and the circular economy. The program forces the battery industry to confront uncomfortable realities about child labor, carbon emissions, forced labor, and designs that complicate recycling.

Will passports fix everything wrong with battery supply chains? No. Critics rightfully point out that transparency alone doesn't eliminate problems like child labor in cobalt mines. But passports create accountability mechanisms that make problems harder to ignore and easier for consumers, investors, and regulators to act upon.

The technology and infrastructure are ready. Blockchain platforms, QR code systems, and cloud databases all work reliably at scale. The BASE project and numerous industry pilots have demonstrated technical feasibility. The remaining challenges are organizational, economic, and political rather than technical.

The transformation extends beyond Europe's borders. While the EU mandates passports, their influence spreads through global supply chains. A cobalt mine in Africa, a lithium refinery in China, a cell plant in South Korea - all must adapt to passport requirements if they want to serve the European market. Given Europe's size and influence, other major markets may well follow with similar requirements.

As battery demand grows tenfold by 2030 to support the energy transition, sustainability frameworks like passports become essential. Without strong traceability and accountability mechanisms, rapid expansion could exacerbate environmental damage and human rights violations. Passports offer a tool to scale battery production responsibly.

The coming months will reveal which companies prepared adequately and which underestimated the complexity of compliance. For the battery industry, February 18, 2027 marks the beginning of a new era of transparency, accountability, and hopefully, sustainability.

Ahuna Mons on dwarf planet Ceres is the solar system's only confirmed cryovolcano in the asteroid belt - a mountain made of ice and salt that erupted relatively recently. The discovery reveals that small worlds can retain subsurface oceans and geological activity far longer than expected, expanding the range of potentially habitable environments in our solar system.

Scientists discovered 24-hour protein rhythms in cells without DNA, revealing an ancient timekeeping mechanism that predates gene-based clocks by billions of years and exists across all life.

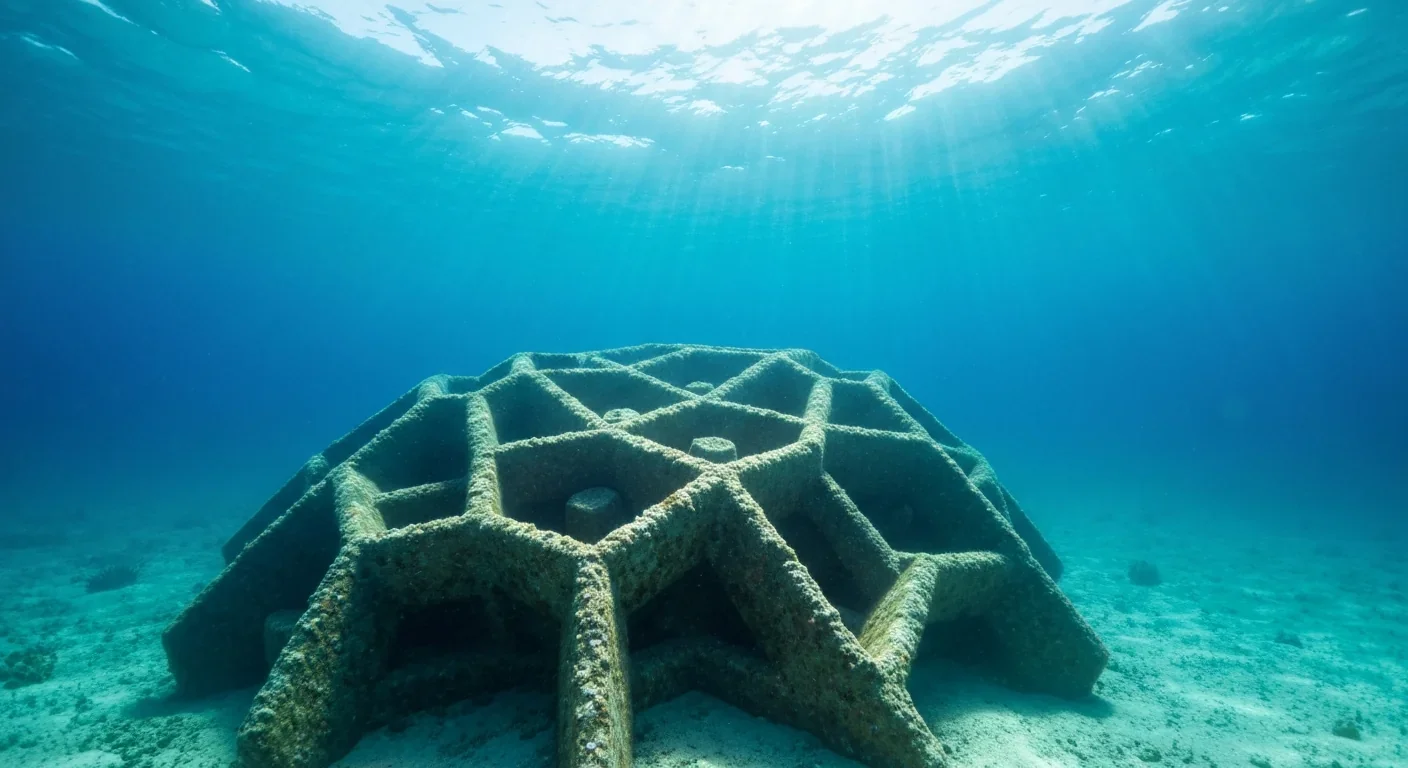

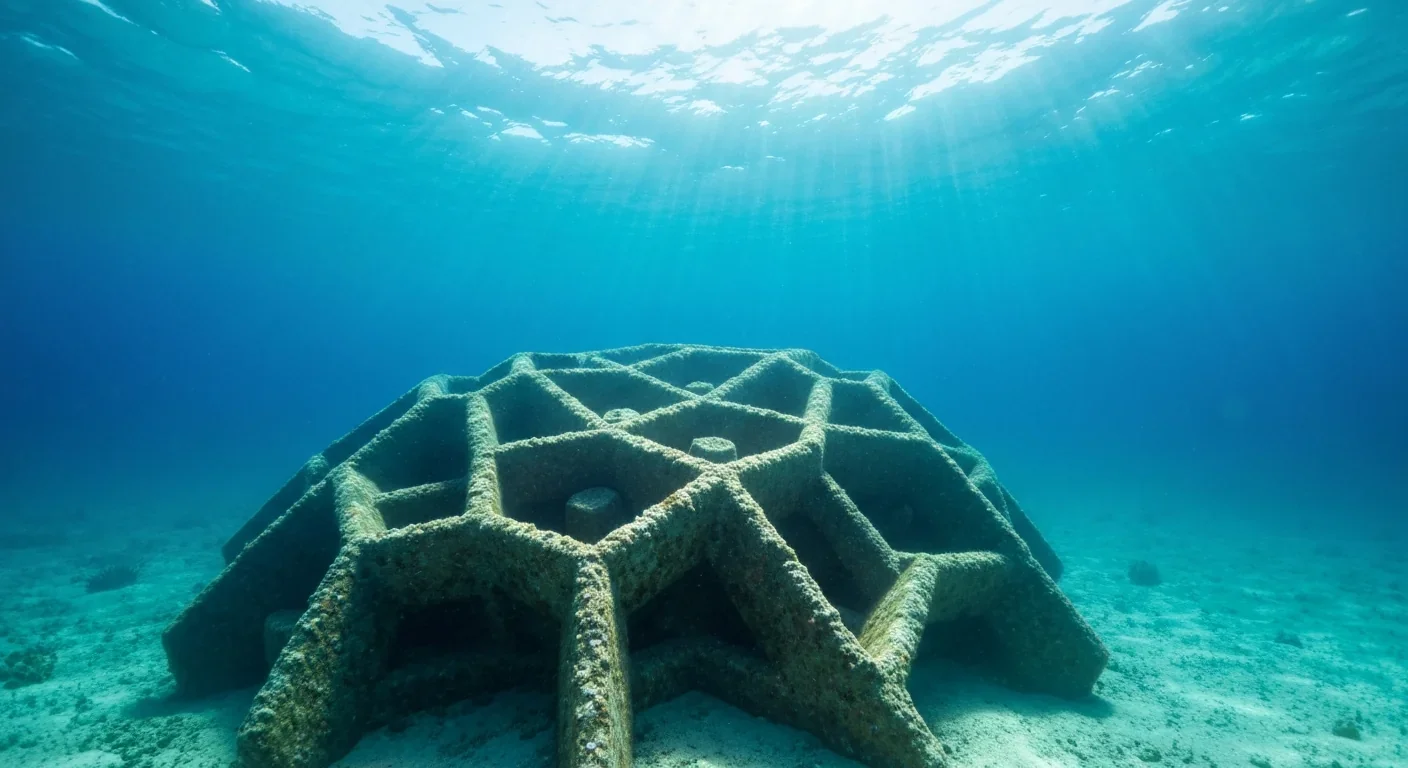

3D-printed coral reefs are being engineered with precise surface textures, material chemistry, and geometric complexity to optimize coral larvae settlement. While early projects show promise - with some designs achieving 80x higher settlement rates - scalability, cost, and the overriding challenge of climate change remain critical obstacles.

The minimal group paradigm shows humans discriminate based on meaningless group labels - like coin flips or shirt colors - revealing that tribalism is hardwired into our brains. Understanding this automatic bias is the first step toward managing it.

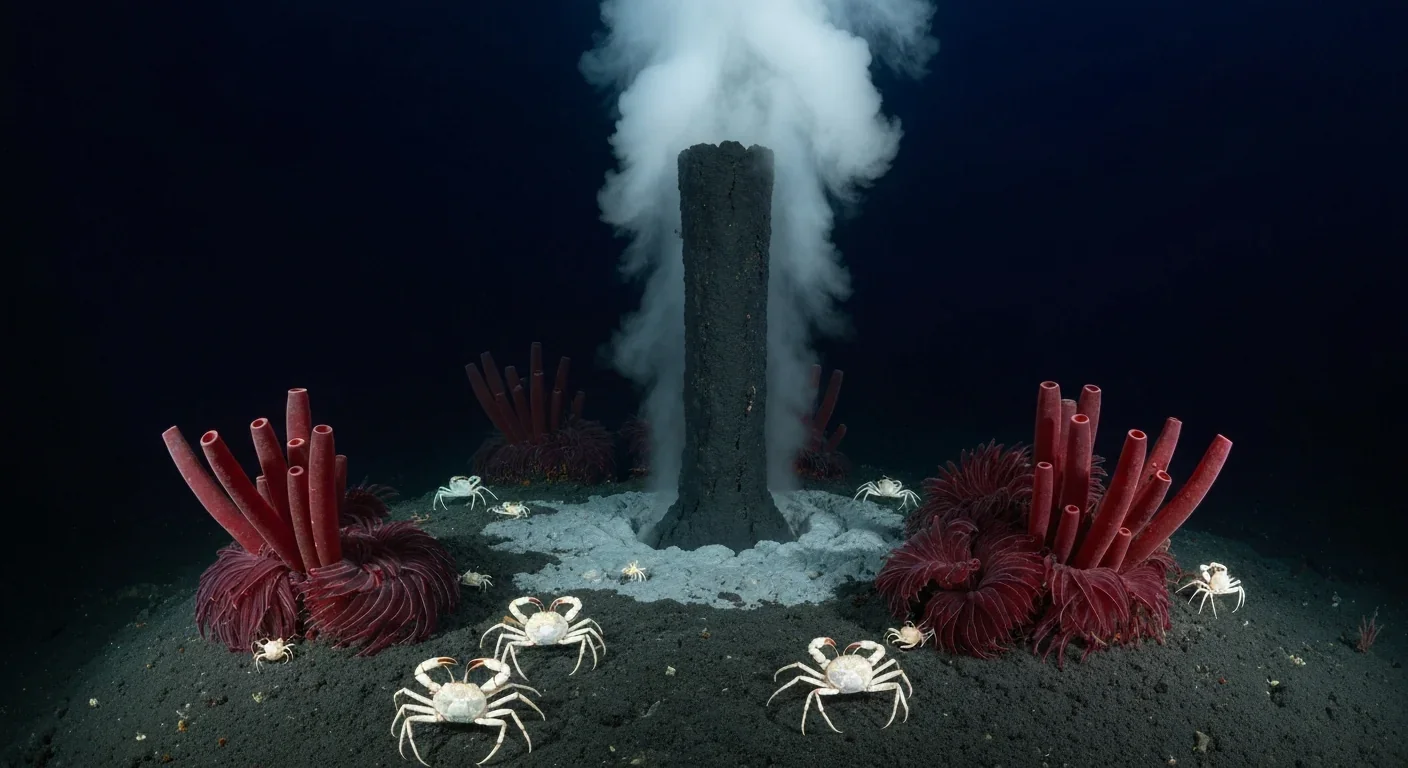

In 1977, scientists discovered thriving ecosystems around underwater volcanic vents powered by chemistry, not sunlight. These alien worlds host bizarre creatures and heat-loving microbes, revolutionizing our understanding of where life can exist on Earth and beyond.

Automated systems in housing - mortgage lending, tenant screening, appraisals, and insurance - systematically discriminate against communities of color by using proxy variables like ZIP codes and credit scores that encode historical racism. While the Fair Housing Act outlawed explicit redlining decades ago, machine learning models trained on biased data reproduce the same patterns at scale. Solutions exist - algorithmic auditing, fairness-aware design, regulatory reform - but require prioritizing equ...

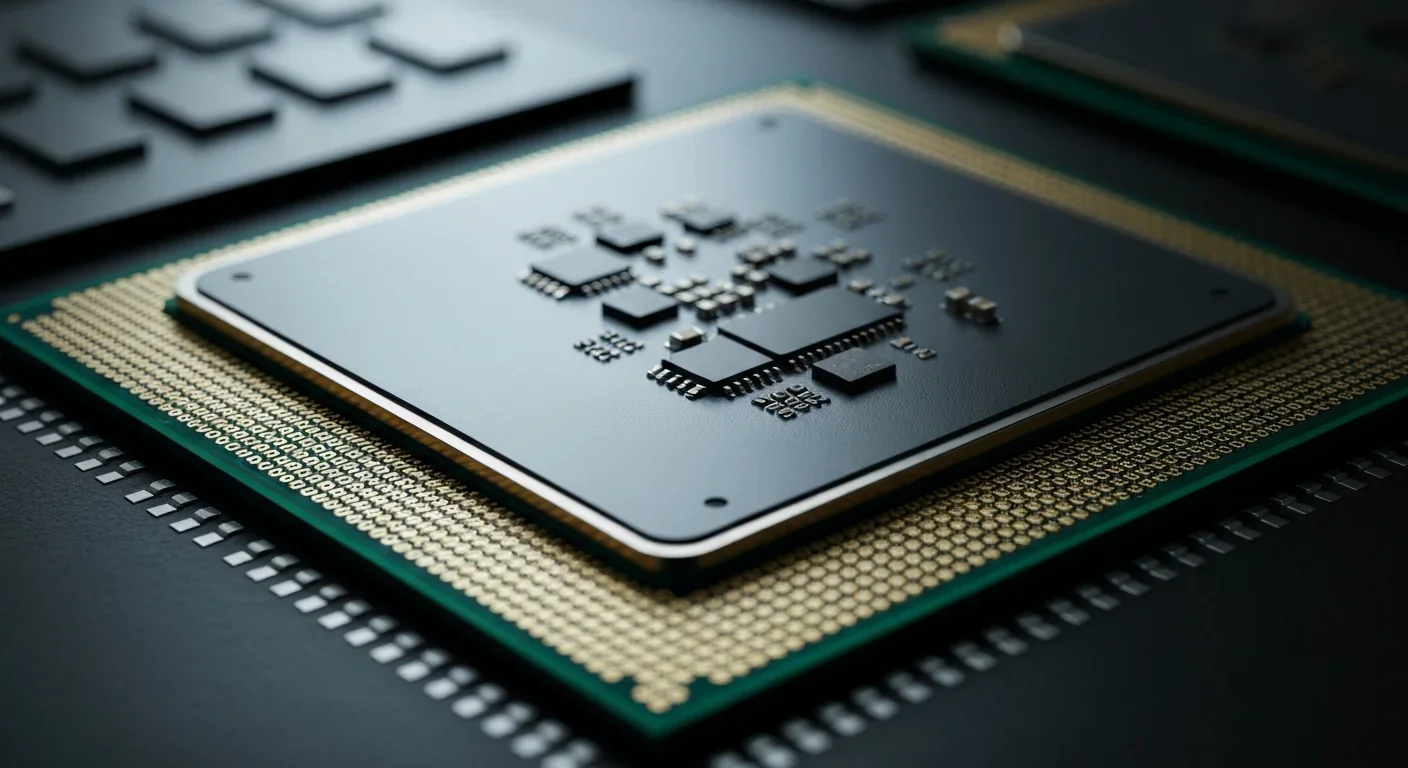

Cache coherence protocols like MESI and MOESI coordinate billions of operations per second to ensure data consistency across multi-core processors. Understanding these invisible hardware mechanisms helps developers write faster parallel code and avoid performance pitfalls.