3D-Printed Coral Reefs: Can We Engineer Marine Recovery?

TL;DR: Edible cutlery is transforming from novelty to viable industry, valued at $46.38 billion in 2024 and projected to reach $115.80 billion by 2034. Made from grains like wheat, rice, and millet, these utensils offer a sustainable alternative to plastic waste but face challenges in cost, taste, and scaling production.

Every year, humanity produces roughly 40 billion plastic utensils that will outlive us all. These forks, spoons, and knives take around 450 years to decompose, piling up in landfills and oceans while we move on to our next meal. But what if your spoon could disappear in minutes instead of centuries? What if the solution to our throwaway culture was simply to eat the problem? That's exactly what the edible cutlery industry is banking on, and the numbers suggest they're onto something big.

The edible cutlery market was valued at $46.38 billion in 2024, with projections showing it'll hit $115.80 billion by 2034. That's a compound annual growth rate of 10.7%, which means this isn't just a trendy startup idea anymore. Real money is flowing into what was, until recently, considered a curiosity at best.

The shift happened because the plastic problem became impossible to ignore. Single-use plastic cutlery contributes massively to the estimated 8 million tons of plastic entering our oceans annually. Microplastics from degraded utensils show up in seafood, drinking water, even human blood. When you realize your disposable fork might be contaminating your body with particles researchers are only beginning to understand, suddenly eating your spoon doesn't sound so weird.

Microplastics from disposable cutlery have been detected in human blood, seafood, and drinking water, raising urgent questions about the long-term health impacts of our throwaway culture.

Governments noticed too. The European Union banned single-use plastics in 2021. Canada followed. India implemented restrictions on plastic cutlery in 2022. Each new regulation created market pressure that transformed edible cutlery from novelty to viable business opportunity. When compliance costs money and alternatives exist, industries adapt quickly.

Creating something you can both eat with and eat isn't as simple as baking a cracker in the shape of a spoon. Edible cutlery manufacturing requires specialized equipment and premium ingredients, which explains why production costs run 3-5 times higher than conventional plastic alternatives.

The base ingredients vary, but the principles remain consistent. Most manufacturers use grains like wheat, rice, millet, or sorghum as the foundation. Bakeys Food Private Limited, one of India's pioneering companies in this space, produces spoons from jowar (sorghum), rice, and wheat flour. Their production facility in Hyderabad, expanded in September 2024, now cranks out 2.5 million edible spoons daily, a 150% capacity increase that signals serious commercial momentum.

The manufacturing process involves grinding grains into fine flour, mixing with water and sometimes binding agents, molding the mixture into utensil shapes, baking or drying at controlled temperatures, and rigorous quality control testing. Each stage adds operational expenses, but also creates a product that must survive being submerged in hot soup without dissolving immediately while remaining edible and reasonably pleasant to eat.

Research teams have explored increasingly sophisticated formulations. A recent study published in the Journal of Nutrition and Food Security examined roasted sorghum and flower powder-enriched edible cutlery, evaluating nutritional, sensory, and textural properties. Their findings showed you could optimize for structural integrity and taste simultaneously. Millet-based alternatives demonstrated superior protein content compared to wheat-based versions, making the utensils nutritionally meaningful rather than empty calories.

Flavoring presents both opportunity and challenge. Some companies produce neutral-tasting utensils that won't interfere with food flavors. Others offer varieties like sweet, savory, or spiced options that complement specific dishes. The trade-off is universal appeal versus enhanced experience. A chocolate-flavored spoon works great for ice cream but less so for curry.

Market projections look impressive until you examine actual consumer behavior. Despite growing environmental awareness, adoption rates remain uneven across demographics and regions. The data shows approximately 73% of consumers express willingness to pay premium prices for environmentally responsible products, but willingness doesn't always translate to purchase behavior.

"73% of consumers express willingness to pay premium prices for environmentally responsible products, yet actual purchase behavior tells a more complex story about price sensitivity and habit change."

- Emergen Research Market Analysis

Cost remains the primary barrier. When plastic utensils cost fractions of a cent and edible alternatives cost several cents or more, price-sensitive consumers and businesses hesitate. Fast-casual restaurants operate on thin margins. Adding even five cents per customer to utensil costs impacts profitability significantly when you're serving hundreds of meals daily.

The taste and texture issue can't be dismissed either. Eating your spoon sounds novel until you experience the sensation of soggy, dissolving grain material breaking apart in your mouth. Early versions of edible cutlery earned criticism for exactly this problem. Modern formulations have improved dramatically, with some lasting 30-40 minutes in hot liquids before significant degradation, but consumer perceptions lag behind product improvements.

Allergies and dietary restrictions add complexity. Wheat-based utensils exclude anyone with celiac disease or gluten intolerance. Rice alternatives accommodate gluten-free needs but may not suit other dietary preferences. Manufacturers must either create multiple product lines or accept limited market reach. Some companies produce rice bran and wheat bran combinations to balance cost, durability, and allergen concerns.

Then there's the cultural dimension. In some regions, eating with your hands is traditional and acceptable. Introducing edible cutlery there feels redundant. In cultures where formal dining emphasizes metal silverware and fine table settings, suggesting people eat their forks might seem gauche regardless of environmental benefits. The product's appeal varies dramatically depending on existing eating customs and sustainability consciousness.

Despite challenges, real-world implementation is happening, and specific sectors are leading adoption. The airline industry represents one of the most promising markets for edible and compostable cutlery. Airlines serve millions of meals annually, each requiring utensils that previously went straight to landfills. Weight matters in aviation, where every gram affects fuel consumption. Biodegradable and edible utensils often weigh less than plastic equivalents, creating both environmental and economic incentives.

Several airlines have already made the switch. Industry reports from 2024 documented major carriers transitioning to sustainable utensils for economy class meals. The controlled environment of airline service addresses several adoption barriers. Passengers receive meals for immediate consumption, eliminating long-term storage concerns. The captive audience can't easily choose conventional alternatives. Brand reputation benefits justify higher costs that spread across ticket prices.

Catering services at large events discovered similar advantages. Music festivals, conferences, and sports venues generate enormous waste. Switching to edible cutlery that attendees can consume or compost reduces cleanup costs and environmental impact simultaneously. When you're serving 50,000 people at a multi-day festival, waste management becomes a significant logistical and financial burden. Event organizers report that sustainable utensils reduced post-event cleanup time by 30-40% in some cases.

Institutional food service represents another growth area. Universities, hospitals, and corporate cafeterias serve high volumes to relatively captive audiences with predictable consumption patterns. Many institutions have sustainability commitments or green building certifications that require minimizing disposable plastic use. Edible cutlery helps meet those targets while potentially adding unique marketing value. A university can promote its environmental leadership through tangible, visible changes that students notice daily.

The European market has been particularly receptive. In March 2024, Biotrem partnered with METRO AG, a major food service distributor, to supply wheat bran-based edible cutlery across 24 countries. The partnership included co-marketing initiatives and staff training programs to support restaurant adoption and consumer education. When major distributors commit to carrying sustainable alternatives, it signals market maturation beyond niche products.

Retail availability is expanding too. Companies like FlavorFulz sell directly to consumers online, positioning edible utensils as conversation pieces for parties and gatherings. The pitch shifts from environmental necessity to novel experience, which helps overcome price sensitivity. People will pay premium prices for novelty and social media appeal even when they wouldn't for pure sustainability.

The industry faces a classic chicken-and-egg problem. Manufacturing costs remain high because production volumes are relatively low. Volumes stay low because high costs limit adoption. Breaking this cycle requires substantial capital investment in automation and production capacity before market demand has fully materialized.

Current production economics tell the story. Specialized equipment for mixing, molding, baking, and quality control represents significant upfront investment. Raw materials cost more per unit than plastic resin, and grain prices fluctuate with agricultural conditions. Labor costs for inspection and packaging remain relatively high since automation hasn't reached the sophistication level of plastic utensil manufacturing.

Compare this to conventional plastic cutlery production, which benefits from decades of optimization and massive economies of scale. Plastic injection molding machines can produce thousands of units per hour with minimal human oversight. Material costs are predictable and low. The entire supply chain has been refined for maximum efficiency and minimum cost.

Breaking the cost barrier requires a classic catch-22 solution: massive production investment before market demand fully materializes, betting that scale will eventually make edible cutlery price-competitive with plastic.

For edible cutlery to compete on price, production volumes need to increase by orders of magnitude. That means manufacturers must either accept years of losses while building market share, or find investors willing to fund capacity expansion before profits materialize. Bakeys' facility expansion demonstrates one approach: aggressive growth funded by investors betting on regulatory trends and consumer shifts forcing market transformation.

Patent strategies also influence economics. Food technology patents protect novel formulations and manufacturing processes, which helps companies justify R&D investments and maintain pricing power. But patents also prevent rapid commoditization that would drive prices down through competition. The balance between protecting innovation and enabling market growth remains delicate.

Government support could accelerate the transition. Subsidies for sustainable packaging, taxes on single-use plastics, or procurement requirements for public institutions would shift economics favorably for edible cutlery producers. Some regions have implemented such policies, but the patchwork of different regulations across markets complicates scaling for manufacturers trying to serve multiple geographies.

Here's something most people don't consider: edible cutlery isn't just replacing plastic waste; it's adding food to your diet. That raises questions about nutritional content, food safety regulations, and labeling requirements that don't apply to conventional utensils.

Most edible cutlery contains 15-40 calories per piece, primarily from the grain base. A spoon made from millet flour provides small amounts of protein, fiber, and minerals. It's not nutritionally dense, but it's not empty calories either. Nutritional analyses show edible utensils can contribute meaningfully to daily grain intake, especially in formulations enriched with seeds or nutritious flour blends.

This creates regulatory complexity. Is an edible spoon a food product or a utensil? Different classifications mean different safety testing, labeling requirements, and manufacturing standards. Food safety authorities have been catching up to the innovation, but regulations vary internationally. A product approved for sale in India might need different certifications for European or North American markets.

Allergen labeling becomes mandatory rather than optional. If your spoon contains wheat, customers with celiac disease need to know. If you use sesame seeds for flavor or texture, severe allergies require clear warnings. This adds compliance costs and complexity compared to plastic utensils that require no such disclosures.

Shelf life presents another consideration. Plastic cutlery remains usable indefinitely under normal conditions. Edible alternatives have expiration dates like any food product. Moisture, temperature, and storage conditions affect quality and safety. Restaurants and food service operations must implement proper storage and rotation practices, adding operational complexity.

Some entrepreneurs have turned nutritional content into a marketing advantage rather than a regulatory burden. Edible cutlery enriched with superfoods like chia seeds, flax, or protein supplements positions the product as health-conscious choice beyond just sustainability. The pitch becomes: Why throw away your utensil when you could eat something nutritious instead?

The edible cutlery story plays out differently across continents, shaped by local environmental pressures, economic conditions, and cultural attitudes toward innovation.

India has emerged as both innovation center and major market. Companies like Bakeys originated there, driven by severe plastic pollution problems, large populations increasingly concerned about environmental degradation, and growing middle class willing to experiment with sustainable alternatives. Indian startups have been particularly creative with ingredient sourcing, using locally abundant grains and traditional food processing knowledge to develop cost-effective formulations.

IncrEdible Eats, which appeared on Shark Tank, represents the American entrepreneurial approach. The company positioned edible cutlery as innovative food technology rather than mere plastic replacement, emphasizing flavor varieties and novelty appeal. This marketing strategy resonated with consumers who might try the product for fun and convenience rather than primarily environmental reasons. The American market often adopts sustainable products when they offer added value beyond just being eco-friendly.

"The EU's single-use plastics ban didn't just create opportunity for edible cutlery - it forced mandatory market transformation, accelerating adoption faster than consumer choice alone would have achieved."

- European Environmental Policy Analysis

European adoption has been regulatory-driven but increasingly enthusiastic. The EU's single-use plastics ban created mandatory market transformation, forcing businesses to find alternatives or face penalties. This top-down approach accelerated adoption faster than purely market-driven change would have achieved. European consumers, already accustomed to paying more for sustainable products, accepted price premiums more readily than counterparts in markets without strong environmental policy frameworks.

Asian markets beyond India show mixed patterns. Japan, with advanced waste management systems and cultural emphasis on quality and innovation, has been receptive to high-end edible cutlery offerings. China's massive food service industry represents enormous potential market, but price sensitivity and established supply chains create adoption barriers. Southeast Asian countries dealing with severe plastic pollution show growing interest, particularly in tourist-facing businesses where sustainable practices enhance brand appeal.

Latin American and African markets remain relatively underpenetrated. Economic factors explain part of this, as price premiums prove harder to justify in markets with lower average incomes. But opportunity exists in regions where plastic pollution is visible and urgent, and where local agricultural resources could enable cost-effective production using regionally appropriate crops.

The Wikipedia entry on edible tableware notes historical precedents from various cultures that used edible plates and cups long before plastic waste became a concern. This historical context suggests the concept isn't foreign or strange but rather a return to practices that made sense before cheap disposable plastics became ubiquitous.

Research and development in edible cutlery continues advancing, addressing current limitations while exploring new possibilities. University labs and corporate R&D teams are working on several fronts simultaneously.

Material science innovations focus on creating stronger, more durable formulations that maintain structural integrity longer without compromising edibility or taste. Researchers experiment with different grain combinations, fiber reinforcement, and natural binding agents. Studies on millet-based cutlery demonstrated improved protein content and texture compared to wheat-based versions, suggesting continued formulation improvements are achievable.

Coating technologies represent another research direction. Applying thin, edible coatings could extend the time utensils remain rigid in hot or liquid foods while keeping them completely consumable. Natural waxes, plant-based polymers, or protein films might provide protective barriers without resorting to non-edible materials.

Flavor engineering is becoming more sophisticated. Early edible cutlery tasted like cardboard because manufacturers prioritized structural integrity over palatability. Now flavor scientists are creating varieties that complement foods: savory umami spoons for soups, sweet vanilla forks for desserts, neutral options for versatile use. Companies like FlavorFulz offer multiple flavor profiles, treating the utensil as part of the eating experience rather than just a functional tool.

Manufacturing process innovation aims to reduce costs through automation and efficiency gains. Faster production cycles, reduced energy consumption, and improved quality control systems could narrow the price gap with plastic alternatives. Some manufacturers are exploring continuous production methods rather than batch processing to increase throughput.

Packaging innovations address how to store and transport edible cutlery without degradation. Moisture-proof packaging, individual wrapping, and nitrogen flushing techniques help extend shelf life and maintain product quality from factory to consumer. Better packaging also facilitates retail distribution and reduces waste from damaged products.

Within the next decade, you'll likely encounter edible cutlery regularly, whether you seek it out or not. The trajectory is clear even if the timeline remains uncertain. As production scales up and costs come down, more businesses will make the switch, making the experience increasingly common and normalized.

Your dining choices are expanding. Soon you might order soup and choose between conventional, compostable, or edible utensils based on preference, dietary needs, or simple curiosity. Restaurants could offer flavor-matched edible cutlery as an enhancement to their menu offerings, turning functional items into part of the culinary experience.

Environmental impact could become tangible and personal. Instead of wondering whether your plastic fork will end up in the ocean, you could eat it and know for certain it won't. That direct connection between action and outcome appeals to people who feel powerless about larger environmental challenges.

The innovation might extend beyond cutlery. If edible utensils succeed commercially, the same principles could apply to plates, cups, bowls, and food packaging. Imagine unwrapping your sandwich and eating the wrapper, or finishing your coffee and consuming the cup. Each application that eliminates plastic waste compounds the environmental benefit.

Skills might evolve too. Chefs could learn to create flavor pairings that account for edible utensils. Home cooks might make their own using recipes and molds. Eating etiquette could adapt to include whether finishing your utensil is expected, appreciated, or optional depending on social context.

The technology carries implications beyond environmental sustainability. It represents a broader shift toward designing products with end-of-life considerations built in from the start, rather than creating problems we solve later. This circular thinking applies to countless industries and products beyond dining utensils.

Whether edible cutlery becomes dominant or remains one option among several sustainable alternatives, the plastic utensil's days are numbered. Multiple converging factors practically guarantee this outcome: tightening regulations, growing corporate sustainability commitments, increasing consumer demand, and advancing alternatives that improve constantly.

If you work in food service, the question isn't whether to transition but how quickly and to which alternatives. Starting pilot programs now lets you learn what works before regulations force immediate change. Testing different options with customers provides valuable feedback that influences final decisions.

If you're a consumer, trying edible cutlery once demystifies it. You'll discover it's neither miracle solution nor disappointing gimmick but simply another option with trade-offs like any product. Your willingness to accept slight increases in cost or minor inconveniences influences whether businesses feel confident investing in sustainable alternatives.

For investors and entrepreneurs, the edible cutlery market represents a sector where timing matters enormously. Too early and you burn capital building markets that don't exist yet. Too late and you miss the growth phase where early movers establish brand dominance and supply chain advantages. Current market dynamics suggest the sector is transitioning from early adoption to broader rollout, the phase where winners often emerge.

The edible cutlery industry isn't going to single-handedly solve the plastic pollution crisis. But it doesn't need to. It just needs to work well enough, cost little enough, and appeal broadly enough to replace a meaningful percentage of single-use plastic utensils. Even capturing 20-30% of the global market would eliminate billions of plastic pieces annually while proving that better alternatives exist.

The real revolution isn't the spoon you can eat. It's the growing recognition that we can design products that don't poison the planet, even if they cost slightly more or require adjusting our habits. That mindset shift extends far beyond cutlery, and that's what makes this technology truly transformative rather than merely clever.

Ahuna Mons on dwarf planet Ceres is the solar system's only confirmed cryovolcano in the asteroid belt - a mountain made of ice and salt that erupted relatively recently. The discovery reveals that small worlds can retain subsurface oceans and geological activity far longer than expected, expanding the range of potentially habitable environments in our solar system.

Scientists discovered 24-hour protein rhythms in cells without DNA, revealing an ancient timekeeping mechanism that predates gene-based clocks by billions of years and exists across all life.

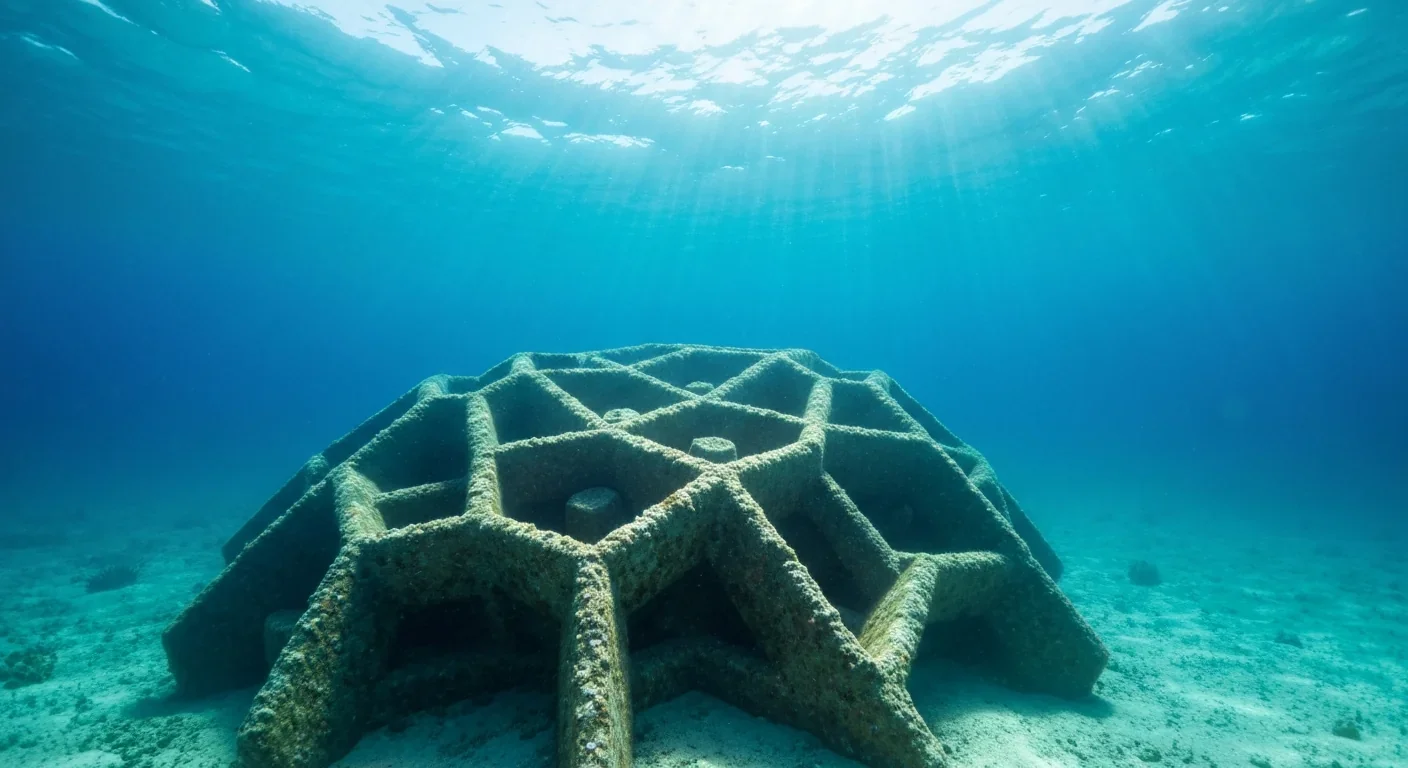

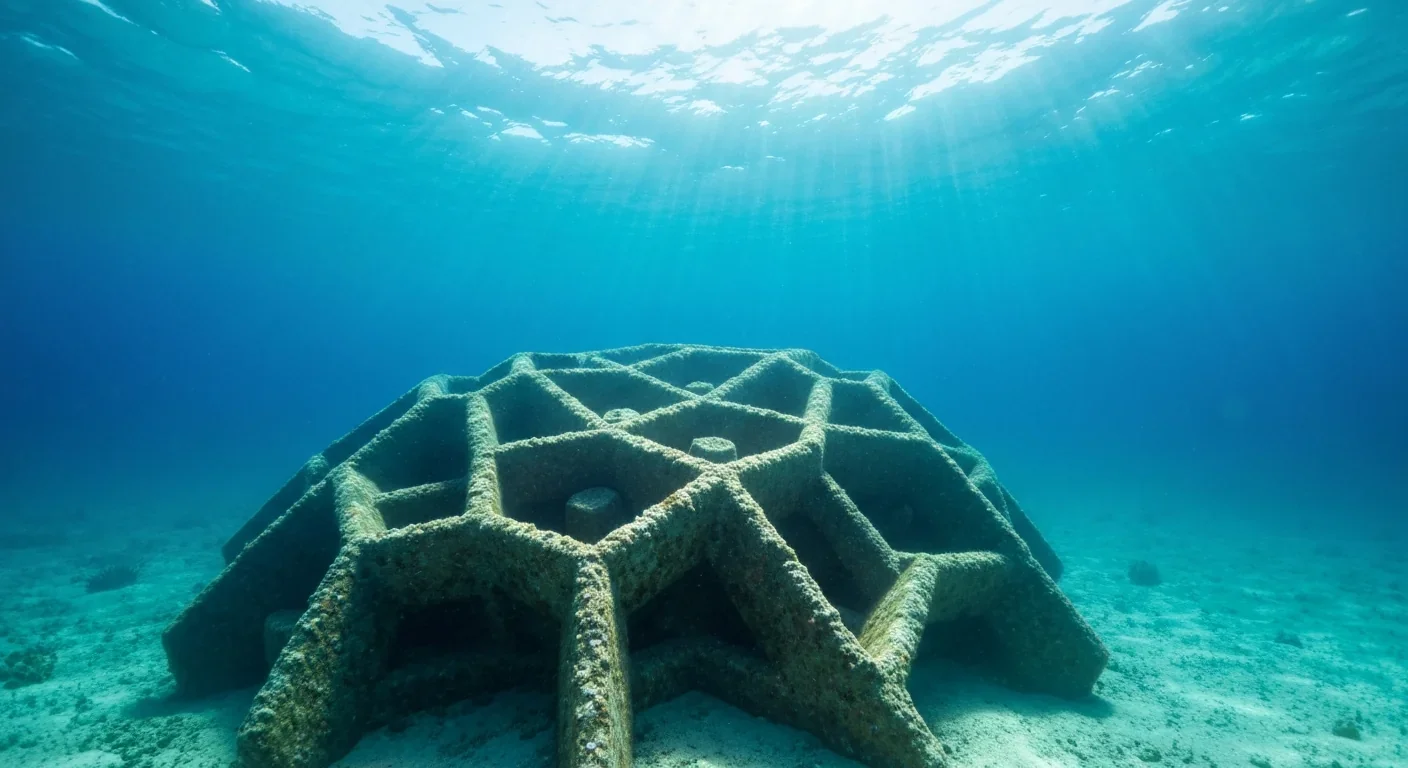

3D-printed coral reefs are being engineered with precise surface textures, material chemistry, and geometric complexity to optimize coral larvae settlement. While early projects show promise - with some designs achieving 80x higher settlement rates - scalability, cost, and the overriding challenge of climate change remain critical obstacles.

The minimal group paradigm shows humans discriminate based on meaningless group labels - like coin flips or shirt colors - revealing that tribalism is hardwired into our brains. Understanding this automatic bias is the first step toward managing it.

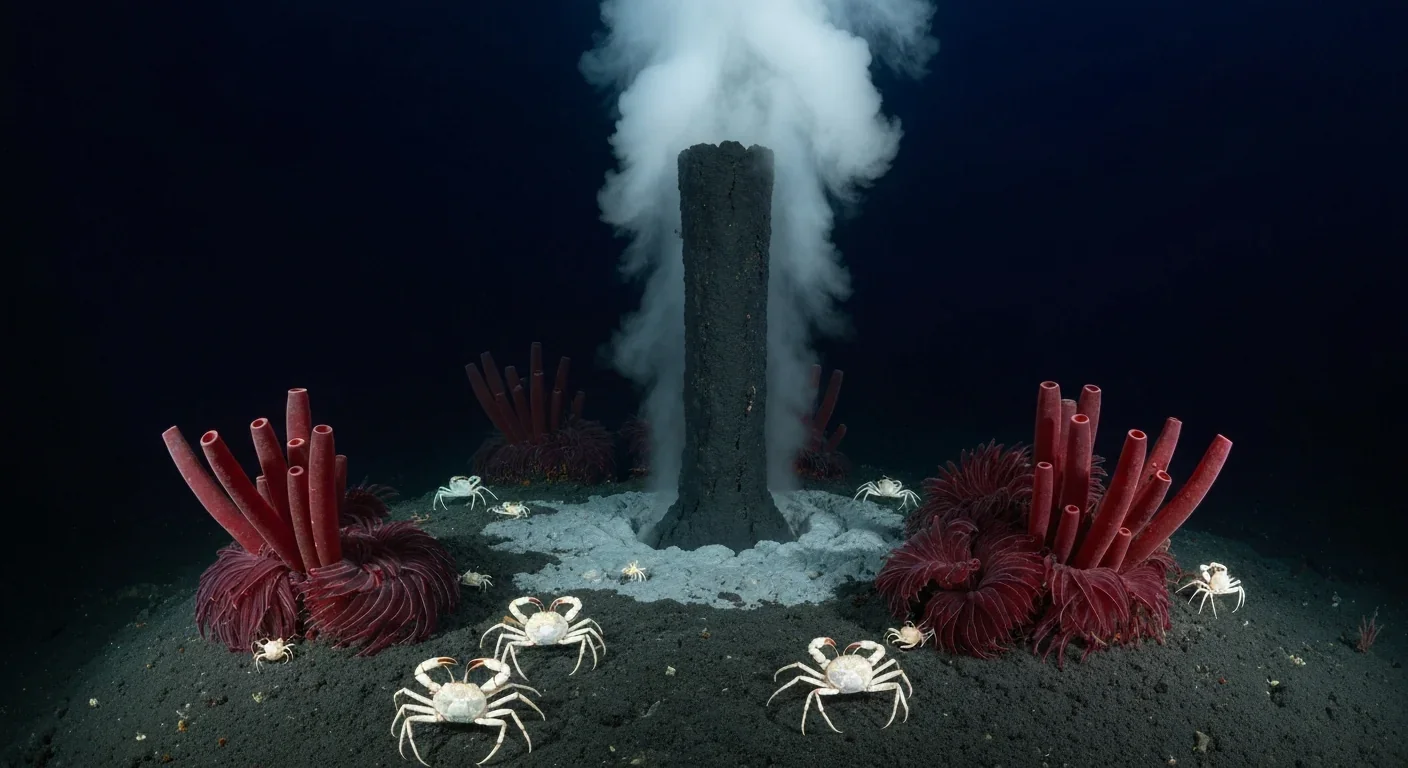

In 1977, scientists discovered thriving ecosystems around underwater volcanic vents powered by chemistry, not sunlight. These alien worlds host bizarre creatures and heat-loving microbes, revolutionizing our understanding of where life can exist on Earth and beyond.

Automated systems in housing - mortgage lending, tenant screening, appraisals, and insurance - systematically discriminate against communities of color by using proxy variables like ZIP codes and credit scores that encode historical racism. While the Fair Housing Act outlawed explicit redlining decades ago, machine learning models trained on biased data reproduce the same patterns at scale. Solutions exist - algorithmic auditing, fairness-aware design, regulatory reform - but require prioritizing equ...

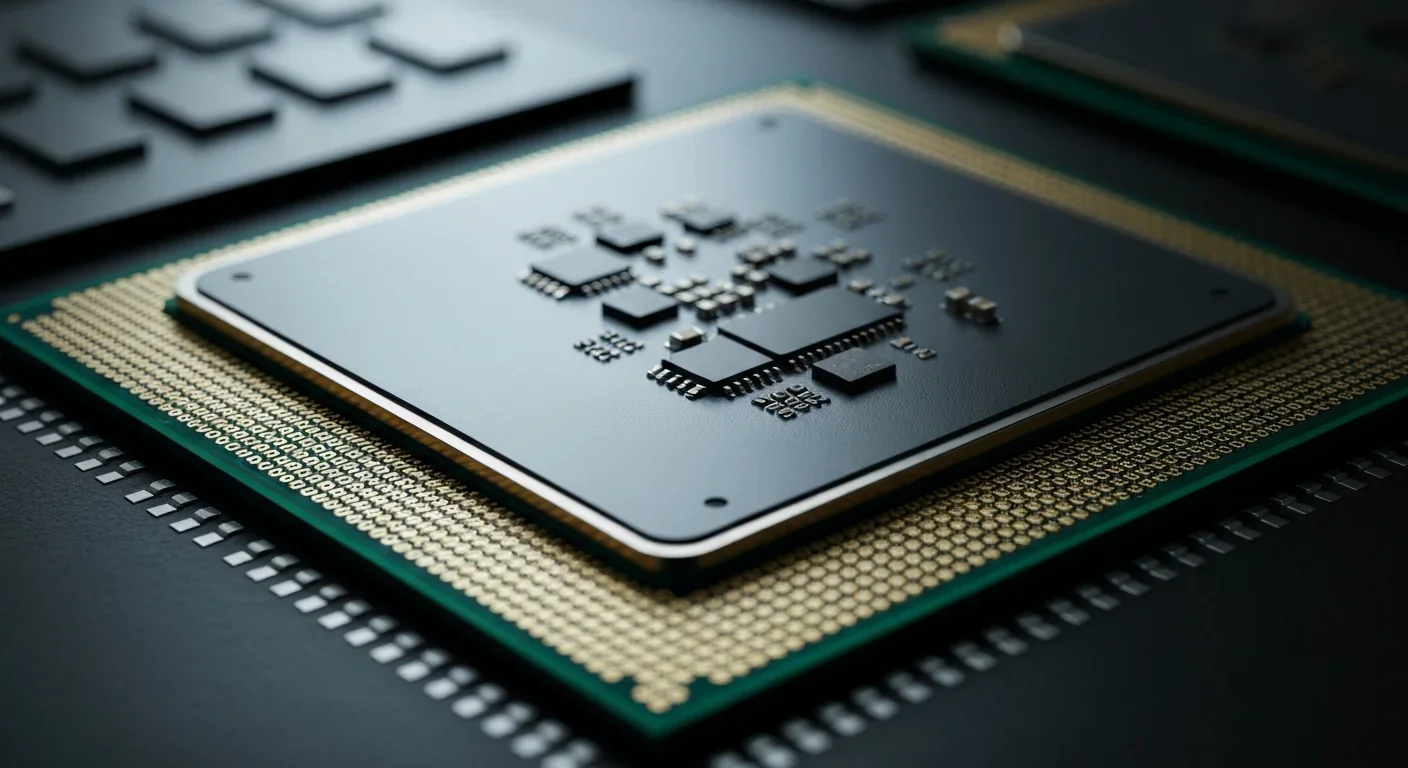

Cache coherence protocols like MESI and MOESI coordinate billions of operations per second to ensure data consistency across multi-core processors. Understanding these invisible hardware mechanisms helps developers write faster parallel code and avoid performance pitfalls.