3D-Printed Coral Reefs: Can We Engineer Marine Recovery?

TL;DR: Polycrisis describes how climate change, economic instability, health emergencies, geopolitical tensions, and tech disruptions become causally entangled, amplifying risks beyond the sum of individual crises and defeating siloed governance approaches.

The world isn't facing one crisis or two or even five. By most counts, we're juggling somewhere between a dozen and twenty major threats simultaneously, each amplifying the others in ways that defy traditional problem-solving. Climate disasters trigger food shortages. Food shortages spark political unrest. Political unrest disrupts supply chains. Supply chains collapsing crash markets. Market crashes undermine climate action funding. And the cycle spins faster.

Welcome to the polycrisis, where the old playbook of tackling problems one at a time has become dangerously obsolete.

The term polycrisis refers to something more sinister than just bad timing. It's not simply multiple crises happening at once. According to the Cascade Institute, polycrisis describes situations where "crises in multiple global systems become causally entangled in ways that significantly degrade humanity's prospects," producing harms greater than the sum of individual impacts through deep systemic interconnections.

Think of it like this: when you have the flu and stub your toe, you're dealing with two separate problems. When you have the flu, which weakens you so much you trip and break your leg, which keeps you bedridden so you develop pneumonia, which overwhelms an already-strained healthcare system dealing with a pandemic - that's polycrisis territory.

Recent research analyzing humanitarian crises identified 34,458 distinct pathways linking conflict-related disruptions to health outcomes through a network of just 138 nodes. The sheer multiplicative effect is staggering. Traditional risk models, built to assess isolated threats, simply can't map this level of complexity.

The abstract horror of systems theory becomes concrete when you look at what happened in North Gaza during 2023-2024. Four children with Hepatitis A, a disease that's usually mild and self-limiting, died from fulminant liver failure. Not because Hepatitis A suddenly became more deadly, but because war-driven disruptions destroyed the systems that would have saved them.

The destruction of water infrastructure meant contaminated drinking sources. Food scarcity meant malnutrition, weakening immune systems. Bombing of healthcare facilities meant no treatment. Fuel blockades meant no medical evacuations. Each factor alone was manageable. Together, they turned a treatable illness into a death sentence.

This is the defining characteristic of polycrisis: the loss of basic survival inputs and collapse of medical response converge, creating dual trajectories that feed off each other. Researchers found that 97% of crisis pathways intersected with 25 key nodes associated with women's roles in caregiving and resource acquisition, showing how crisis amplification follows lines of existing vulnerability.

The financial sector offers another vivid example of polycrisis mechanics. The world's 60 largest banks have extended more than $1.6 trillion in lending to the fossil fuel industry, creating what Finance Watch calls a "double feedback loop" of systemic risk.

First loop: As the world transitions to net-zero, fossil fuel assets will inevitably suffer sharp devaluations, exposing banks to significant transition risks. Second loop: These substantial investments actively finance climate chaos, which contributes to the system-wide buildup of physical climate risks to which those same banks are exposed.

The kicker? Current prudential approaches fall short because quantitative tools like stress tests are poorly suited to the non-linear, forward-looking nature of climate risk. Banking regulators are essentially trying to predict earthquakes using thermometers.

Finance Watch calculates that the current underpricing of fossil fuel risk creates an implicit subsidy of 0.76% on fossil fuel loans, worth an estimated $8.7 billion per year. That's $8.7 billion annually making the polycrisis worse, baked into the structure of global finance.

Understanding the mechanisms of amplification is crucial because it reveals intervention points. Polycrisis operates through several distinct but interconnected pathways:

Feedback loops create self-reinforcing cycles. A severe drought exacerbated by climate change leads to food insecurity, which fuels social unrest, which destabilizes governance, which undermines climate adaptation efforts, which worsens the next drought.

Cascading failures occur when the breakdown of one system triggers sequential collapses. The COVID-19 pandemic combined with the Russia-Ukraine conflict caused energy shortages, food insecurity, rising inflation, and social unrest, each crisis emerging from the interaction of the previous two.

Common vulnerabilities mean that stresses hit the same weak points simultaneously. Climate tipping points threaten to cause abrupt, systemic, and irreversible impacts on economies, security systems, and populations all at once, because modern societies have similar dependencies.

Resource competition intensifies as multiple crises demand the same limited inputs. When healthcare systems, emergency services, and basic infrastructure all need funding simultaneously during compounding disasters, societies face zero-sum choices that guarantee some problems worsen.

Perhaps the most troubling aspect of polycrisis is how thoroughly it defeats existing governance structures. As one analysis notes, traditional hierarchical and siloed governance structures are fundamentally ill-equipped to manage transboundary and cross-sectoral risks.

Germany's National Security Council, for example, currently omits explicit climate security considerations, even though the BND has already identified climate change as a major external threat. This institutional mismatch, repeated across governments worldwide, creates a silent vulnerability where no agency owns the whole problem.

International institutions fare no better. The United Nations Security Council has the legal mandate to address climate tipping points as threats to international peace and security but has yet to formalize this within an official resolution. The gap between authority and action grows wider as crises intensify.

The challenge isn't just bureaucratic inertia. Polycrisis governance requires fundamentally different capabilities: the ability to model complex system dynamics, coordinate across jurisdictional boundaries, make decisions with incomplete information, and act on threats that haven't yet materialized but are gathering force.

Enter artificial intelligence, which offers both potential solutions and new risks. AI systems can identify patterns across vast, heterogeneous datasets, map interdependencies between seemingly unrelated systems, and simulate emergent behaviors arising from interactions at scale.

During the 2020-2022 supply chain disruptions, AI-enhanced mapping systems provided real-time decision support, identifying alternative routing within 24 to 48 hours and reducing critical shortages. Machine learning algorithms analyzing satellite imagery, weather data, economic indicators, and migration flows have successfully predicted climate-economy dynamics in vulnerable regions like the Sahel.

The FEWS NET early warning system uses machine learning to integrate climate, agricultural, economic, and conflict data to predict food security crises before they escalate. These tools represent a quantum leap beyond traditional siloed analysis.

But AI also introduces new complexities. The technology sector's own resource demands, data privacy concerns, algorithmic bias, and potential for misuse create additional crisis vectors. As systems become more interconnected through digital infrastructure, cyber vulnerabilities could themselves trigger polycrisis cascades.

Different regions experience polycrisis through distinct lenses, shaped by geography, development levels, and institutional capacity. For Asia, navigating polycrisis involves managing rapid urbanization alongside climate vulnerability and geopolitical tensions in contested waters. The region faces simultaneous pressures from supply chain disruptions, energy transitions, and demographic shifts.

Southeast Asia confronts the climate crisis fueling political instability, where rising sea levels threaten both agricultural productivity and urban centers, creating migration pressures that strain governance systems already managing ethnic and religious diversity.

European approaches emphasize coordinated governance frameworks, with the EU attempting to build climate resilience into financial regulation and security policy. Yet even these integrated systems struggle with the speed and scale of compounding threats.

For Global South nations, polycrisis often manifests as debt crises intersecting with climate impacts, creating situations where countries most vulnerable to climate change have the least fiscal capacity to adapt. The major global threats facing society disproportionately impact populations with the fewest resources to respond.

So what actually works when everything is connected to everything else? Emerging research and practice point toward several principles:

Systems mapping helps visualize interdependencies before crises cascade. Participatory systems-based tools that capture relationships among crisis domains enable stakeholders to identify critical nodes and intervention points. The Architecture of Systems approach used in Gaza demonstrated how community-centered inquiry can reveal leverage points invisible to top-down analysis.

Cross-sector collaboration breaks down silos that exacerbate crisis amplification. When health ministries, environmental agencies, economic planners, and security services develop shared analytical frameworks, they can anticipate interactions instead of reacting to surprises.

Adaptive planning accepts that uncertainty is irreducible in complex systems. Rather than trying to predict exact outcomes, resilient strategies build in flexibility, redundancy, and rapid learning capabilities. This means maintaining spare capacity even when it seems inefficient, preserving diverse approaches rather than converging on single solutions.

Early warning systems that integrate data across domains can detect emerging polycrisis conditions. Integrated models have successfully forecasted cascading disruptions across sectors, providing lead time for intervention.

Financial restructuring to account for systemic risks could prevent the kind of feedback loops currently embedded in fossil fuel lending. Proposals like climate systemic risk buffers using loan-to-value approaches could remove market distortions without reducing banks' lending capacity.

Equity considerations matter because polycrisis amplifies through existing vulnerabilities. Resilience strategies that ignore distributional impacts risk creating systems that protect some while abandoning others to cascade effects.

Climate scientists talk about tipping points, thresholds beyond which change becomes irreversible. The projected loss of the Greenland and West Antarctic ice sheets would commit humanity to sea level rise of more than ten meters. Economic analysts worry about financial tipping points where confidence collapses become self-fulfilling.

But polycrisis itself has tipping points: moments when the density of interconnections crosses thresholds that make cascades inevitable. When enough critical systems are stressed simultaneously, when enough feedback loops are active at once, when enough common vulnerabilities are exposed, the whole complex can shift into a fundamentally different state.

We may be closer to such thresholds than we realize. Global risk reports consistently identify climate change, economic fragmentation, geopolitical conflict, and technological disruption as top concerns, not in isolation but in dangerous combination.

The polycrisis framing can feel paralyzing in its complexity. If everything affects everything else, where do you even start? But the alternative, treating symptoms in isolation, has demonstrably failed. We've watched as climate policies founder for lack of economic coordination, as economic recovery strategies undermine environmental goals, as security approaches ignore resource scarcities they help create.

The shift required isn't primarily technical, though better tools help. It's conceptual: moving from a worldview of separate, solvable problems to one of interconnected dynamics requiring sustained, coordinated management. That means building institutions capable of thinking systemically, developing professionals trained in complexity, and creating political cultures that reward long-term resilience over short-term wins.

Practically, individuals can develop polycrisis literacy, understanding how crises in one domain may cascade into others. Businesses can map their exposure to interconnected risks and build adaptive capacity. Communities can strengthen local resilience while advocating for coordinated governance structures at higher levels.

The age of isolated crises is over. We're learning, slowly and painfully, that solutions must match the complexity of the problems we face. The polycrisis demands nothing less than a reinvention of how we organize collective action, because in a world where every crisis becomes everyone's crisis, siloed responses aren't just inadequate - they're a recipe for systemic failure.

The clock is ticking. The systems are stressing. And the cascades are already beginning.

Ahuna Mons on dwarf planet Ceres is the solar system's only confirmed cryovolcano in the asteroid belt - a mountain made of ice and salt that erupted relatively recently. The discovery reveals that small worlds can retain subsurface oceans and geological activity far longer than expected, expanding the range of potentially habitable environments in our solar system.

Scientists discovered 24-hour protein rhythms in cells without DNA, revealing an ancient timekeeping mechanism that predates gene-based clocks by billions of years and exists across all life.

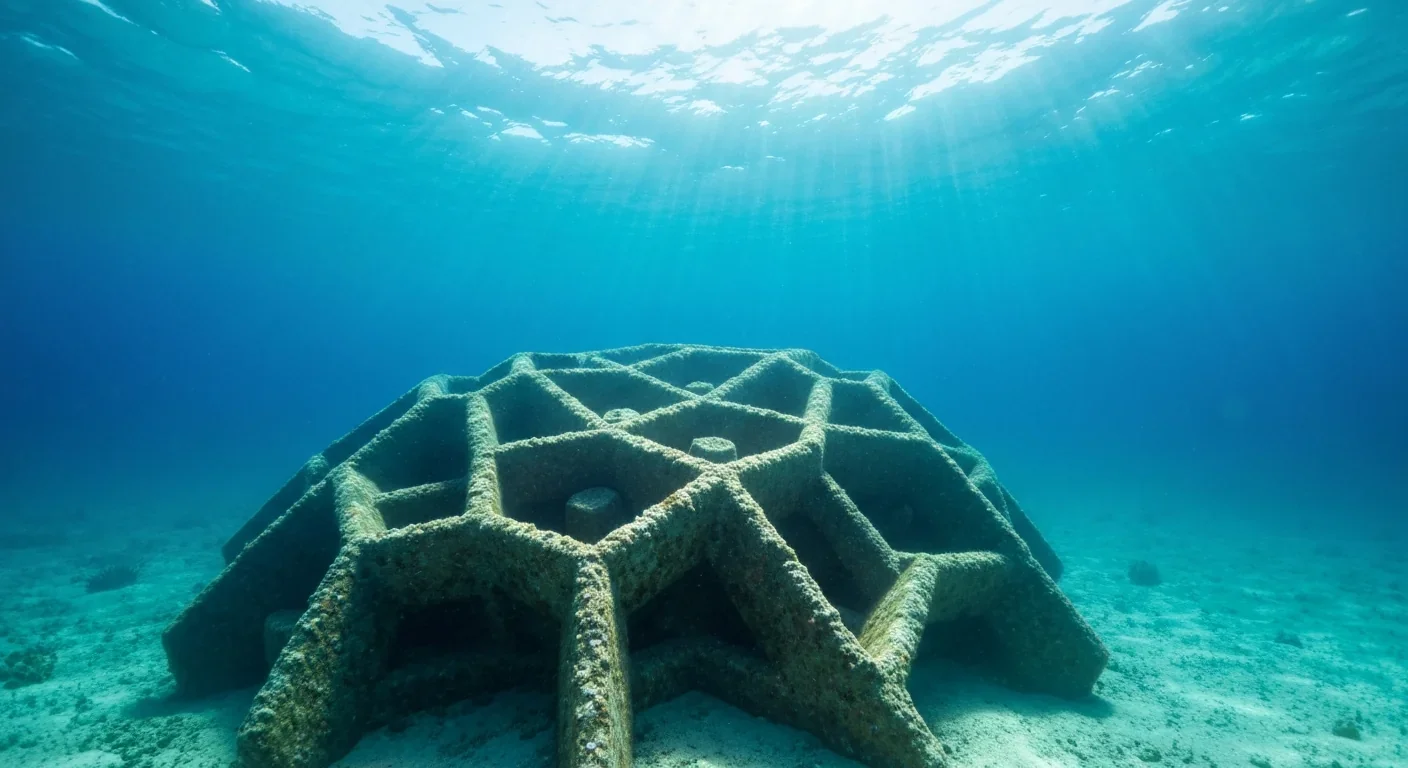

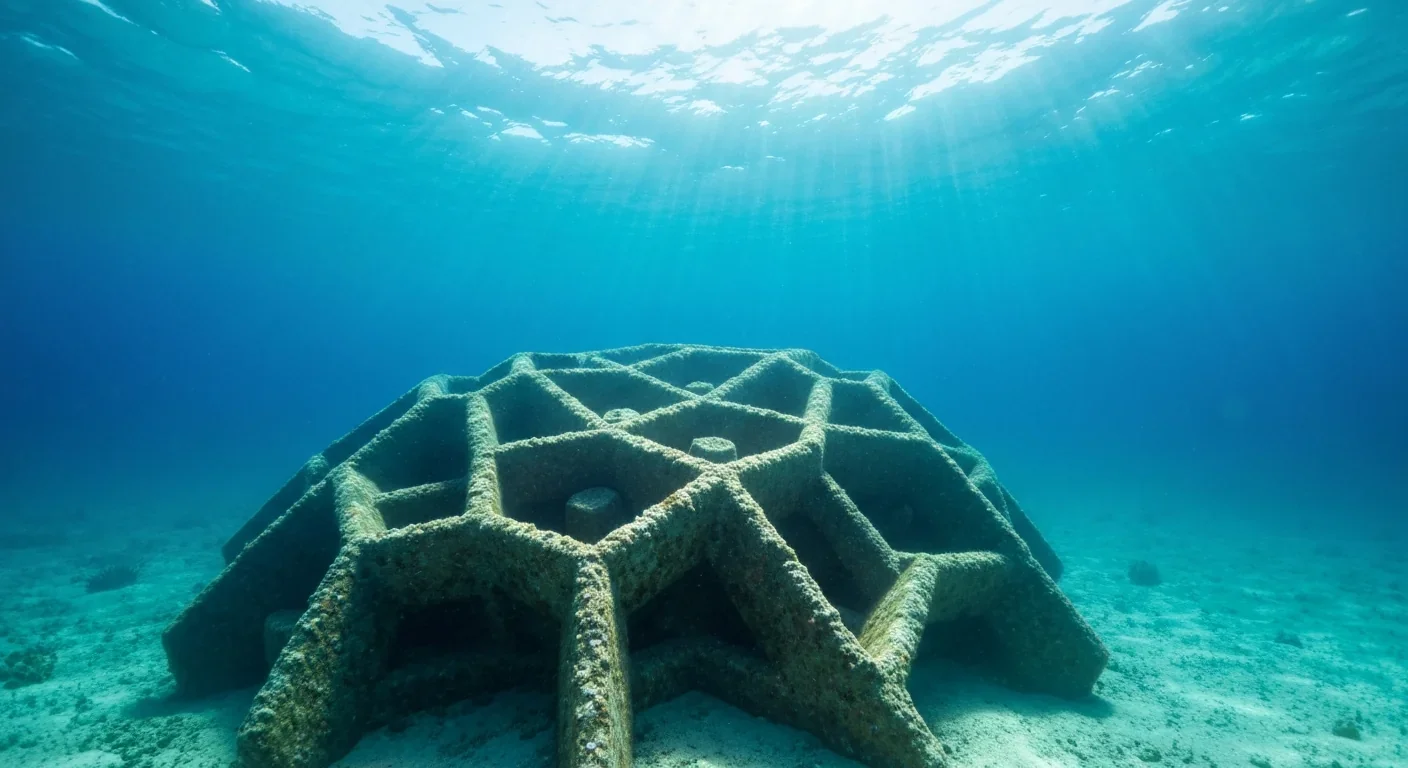

3D-printed coral reefs are being engineered with precise surface textures, material chemistry, and geometric complexity to optimize coral larvae settlement. While early projects show promise - with some designs achieving 80x higher settlement rates - scalability, cost, and the overriding challenge of climate change remain critical obstacles.

The minimal group paradigm shows humans discriminate based on meaningless group labels - like coin flips or shirt colors - revealing that tribalism is hardwired into our brains. Understanding this automatic bias is the first step toward managing it.

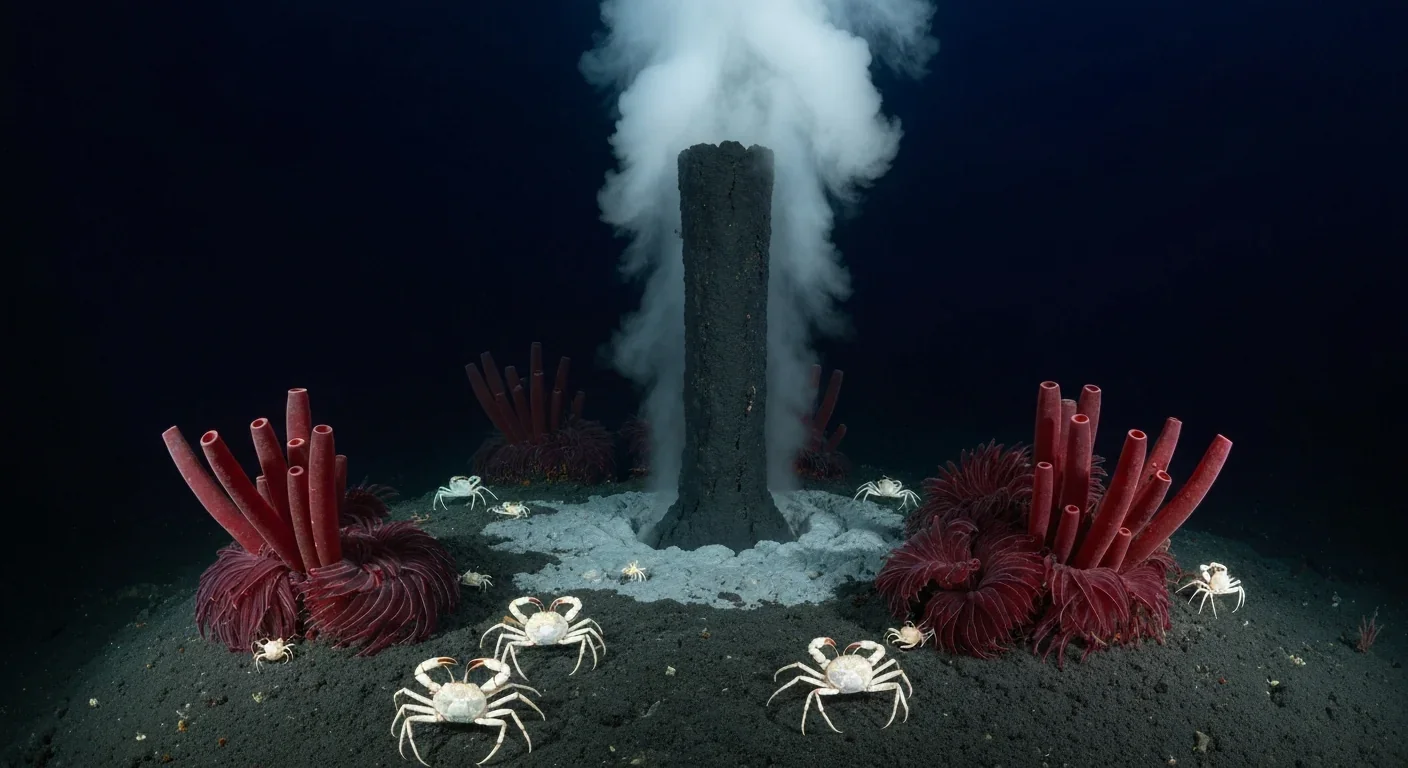

In 1977, scientists discovered thriving ecosystems around underwater volcanic vents powered by chemistry, not sunlight. These alien worlds host bizarre creatures and heat-loving microbes, revolutionizing our understanding of where life can exist on Earth and beyond.

Automated systems in housing - mortgage lending, tenant screening, appraisals, and insurance - systematically discriminate against communities of color by using proxy variables like ZIP codes and credit scores that encode historical racism. While the Fair Housing Act outlawed explicit redlining decades ago, machine learning models trained on biased data reproduce the same patterns at scale. Solutions exist - algorithmic auditing, fairness-aware design, regulatory reform - but require prioritizing equ...

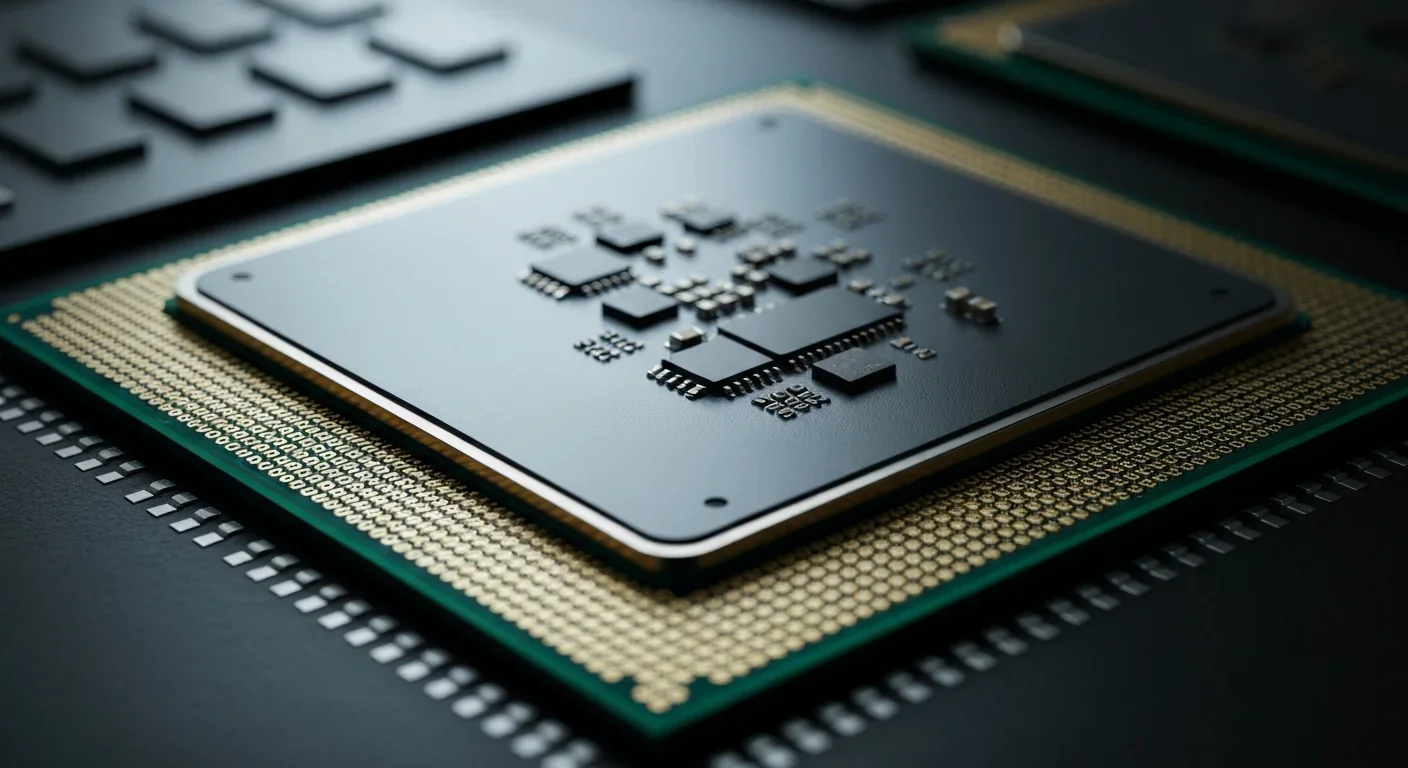

Cache coherence protocols like MESI and MOESI coordinate billions of operations per second to ensure data consistency across multi-core processors. Understanding these invisible hardware mechanisms helps developers write faster parallel code and avoid performance pitfalls.