3D-Printed Coral Reefs: Can We Engineer Marine Recovery?

TL;DR: Pyrolysis oil transforms plastic waste into chemical feedstock by heating it without oxygen, achieving 75-85% conversion rates. The $673.5M market is growing to $1.1B by 2034, driven by policy support.

Imagine walking into a facility where yesterday's plastic bottles and food wrappers are being cooked down into something that looks and acts like crude oil. Not burned. Not buried. Transformed. That's the promise of pyrolysis oil, and it's happening right now in plants from Illinois to Germany. The global plastic waste pyrolysis oil market was worth $673.5 million in 2024 and is projected to hit $1.1 billion by 2034. This isn't just another recycling story. It's about fundamentally rewriting what happens to the 300 million tons of plastic we produce every year.

Pyrolysis sounds complicated, but the core idea is deceptively simple: heat plastic waste in the absence of oxygen until it breaks down into smaller molecules. Think of it as running the oil refining process in reverse. Instead of cracking crude oil into plastics, you're cracking plastics back into liquid hydrocarbons.

The process typically happens between 300°C and 900°C inside sealed reactors. Without oxygen present, the plastic doesn't burn but instead undergoes thermal decomposition. Long polymer chains split into shorter molecules. The result is a dark, viscous liquid that's chemically similar to petroleum, along with combustible gases and a small amount of solid char.

What makes this particularly clever is that those combustible gases can be captured and used to power the pyrolysis reactor itself, making the whole operation more energy-efficient. Conversion rates typically hit 75-85% for suitable plastic waste. That remaining 15-25% becomes fuel gas and char, not waste heading to landfills.

There are different flavors of pyrolysis, each with trade-offs. Slow pyrolysis operates at lower temperatures (around 400-500°C) over several hours, maximizing oil yield and allowing mixed plastic feedstocks. Fast pyrolysis cranks up the heat and speeds through the process in seconds, which can be more efficient but demands cleaner, pre-sorted plastic. The slow pyrolysis segment held $370.1 million of the market in 2024, partly because it can handle the messy reality of post-consumer plastic waste.

Not all plastics perform equally well. Low-density polyethylene (LDPE), the stuff used in plastic bags and packaging film, is the star performer. Its lower melting point and chemical structure make it easier to break down, and it accounted for 35.1% of the market share in 2024. High-density polyethylene (HDPE) and polypropylene (PP) also work well. But PET bottles and PVC are trickier and often excluded from pyrolysis feedstock because they produce lower-quality oil.

The science behind pyrolysis has been around since the 1970s, when oil shocks made alternative fuel sources suddenly very interesting. Early experiments focused on tires and agricultural waste rather than plastics. The technology worked, but it couldn't compete economically with cheap fossil fuels. For decades, pyrolysis remained a niche application.

Then the plastic crisis hit mainstream consciousness. By the 2010s, images of ocean garbage patches and stories about microplastics in drinking water created political pressure for solutions beyond "reduce, reuse, recycle." Mechanical recycling showed its limits: it only works for clean, sorted plastics and degrades material quality with each cycle. Contaminated and mixed plastics, which make up the majority of plastic waste, were still heading to landfills or incinerators.

Chemical recycling, including pyrolysis, emerged as the answer. Unlike melting and reshaping plastic, pyrolysis breaks it down to the molecular level, essentially creating virgin-quality material. This wasn't just an environmental pitch. It was an economic one. Oil companies saw pyrolysis oil as a feedstock they could drop into existing refineries with minimal modification.

Policy shifted the economics further. The European Green Deal and U.S. Renewable Fuel Standard created financial incentives for waste-to-energy projects. Suddenly, building a pyrolysis plant wasn't just environmentally responsible; it was potentially profitable.

Walk into a modern pyrolysis facility and you won't see scientists in lab coats. You'll see industrial-scale reactors processing tons of plastic per day. Agilyx partnered with INEOS Styrolution to build a facility in Channahon, Illinois, capable of processing 100 tons of plastic daily, which equals roughly 36,500 tons per year.

The process starts with feedstock preparation. Incoming plastic waste is shredded into small pieces and sorted to remove non-compatible materials like metals, glass, and certain polymer types. This pre-processing is critical because contamination affects both the efficiency of pyrolysis and the quality of the output oil.

The prepared plastic enters the reactor, where it's heated in an oxygen-free environment. The resulting vapor is condensed into liquid pyrolysis oil, while non-condensable gases are captured and routed back to heat the reactor. Solid residues are removed periodically.

But raw pyrolysis oil isn't ready for prime time. It contains a complex mix of hydrocarbons, some useful and others problematic. Purification and upgrading are essential next steps. Companies like Applied Research Associates have developed processes to remove chlorine, oxygen, and other impurities, transforming raw pyrolysis oil into a product that refineries can confidently use.

The output can then be fed into traditional petrochemical processes. It might become the feedstock for new plastic production, completing a true circular loop. Or it could be refined into fuels. Either way, the carbon that was in plastic waste stays in use rather than escaping as greenhouse gases or piling up in landfills.

Building a commercial-scale pyrolysis plant isn't cheap. Capital costs typically range from $10 million to $50 million depending on capacity and technology. Operating expenses include energy, labor, maintenance, and feedstock processing. The break-even point depends heavily on three variables: the cost of plastic feedstock, the selling price of pyrolysis oil, and available subsidies or credits.

Plastic waste feedstock can sometimes be acquired for free or even at negative cost if municipalities pay to divert it from landfills. But securing consistent, clean feedstock requires logistics and quality control. Contamination or variability in plastic types can tank a batch.

On the revenue side, pyrolysis oil competes with crude oil prices, which are notoriously volatile. When oil prices are high, pyrolysis becomes more attractive. When they crater, margins shrink or disappear. This market exposure has killed promising pilot projects before they reached commercial scale.

Yet the market is growing at a 5.5% annual rate, suggesting that economics are improving. Technology advances are lowering costs. Economies of scale help as facilities grow larger. And policy support, particularly in Europe and parts of Asia, provides revenue stability through tax credits and waste diversion mandates.

There's also an emerging market for certified recycled content. Brands like Unilever and Procter & Gamble have committed to using recycled plastic in their packaging. Mass balance certification, verified by independent auditors, allows companies to track recycled content through complex supply chains. This traceability adds value and helps justify premium pricing.

The headline environmental benefit is obvious: less plastic in landfills and oceans. But the carbon accounting gets more interesting when you dig into it. Pyrolysis can decrease CO2 emissions by 50-75% compared to incineration, which is the main alternative for non-recyclable plastic waste. That reduction comes from avoiding direct combustion emissions and from displacing virgin fossil fuel extraction.

However, pyrolysis isn't carbon-neutral. It requires significant energy input, and unless that energy comes from renewable sources, there's still a fossil fuel footprint. The net environmental benefit depends on what you're comparing it to. Against landfilling, pyrolysis looks great because it avoids methane emissions and leachate contamination. Against high-quality mechanical recycling, pyrolysis is less impressive because it's more energy-intensive. But remember, pyrolysis targets the waste stream that mechanical recycling can't handle.

Pyrolysis plants can emit air pollutants if not properly controlled, including volatile organic compounds and particulate matter. Modern facilities use scrubbers and filters to minimize these emissions, but regulatory oversight varies widely by country. Water use and wastewater treatment are also factors.

The solid residue from pyrolysis, often called char or carbon black, presents both a challenge and an opportunity. It can be used as a low-grade fuel, as a filler in construction materials, or even upgraded into activated carbon for filtration applications.

For all the promise, pyrolysis faces real obstacles. Feedstock quality is the big one. Pyrolysis plants need consistent inputs, but plastic waste is inherently variable. One batch might be mostly LDPE bags; the next could have HDPE bottles, PP containers, and food contamination. This variability affects process efficiency and output quality.

Scaling is another headache. A pilot plant processing a few tons per day can be carefully controlled and optimized. A commercial facility handling 100 tons per day faces entirely different engineering and operational challenges. Heat distribution becomes harder to manage, impurities accumulate faster, and equipment wear accelerates.

Market acceptance of pyrolysis oil is still developing. Refineries and chemical plants are conservative operations that don't like surprises. Introducing a new feedstock, even one that's chemically similar to crude oil, requires extensive testing and process adjustments.

Regulatory uncertainty adds another layer of risk. Is pyrolysis oil considered recycled content or a waste-derived fuel? The classification affects everything from subsidies to emissions reporting to product labeling. Different jurisdictions have different answers, creating a patchwork of rules that complicates scaling across regions.

There's also the uncomfortable truth that chemical recycling, including pyrolysis, could reduce pressure for upstream solutions. If we can profitably convert plastic waste into oil, does that diminish the incentive to reduce plastic production in the first place? Some environmental advocates worry that pyrolysis becomes a justification for business-as-usual rather than a bridge to a genuinely sustainable materials economy.

Geography matters in the pyrolysis story. Asia Pacific dominated the market with $237.3 million in 2024, driven by China, India, and Japan. These countries face enormous plastic waste challenges and have invested heavily in chemical recycling infrastructure.

Europe is taking a different approach, prioritizing regulation and sustainability standards. The European Union's Circular Economy Action Plan sets ambitious recycling targets and provides funding for advanced waste management technologies. Countries like Germany and the Netherlands have multiple pyrolysis pilot projects and commercial facilities.

North America has been slower to adopt pyrolysis at scale, though that's changing. The United States has strong petrochemical infrastructure, which should theoretically make integrating pyrolysis oil easier, but regulatory fragmentation across states creates barriers.

Developing countries face a different calculus entirely. They often lack the capital for expensive pyrolysis facilities and the industrial infrastructure to use the output. Yet they're frequently dealing with the worst plastic waste problems.

There's a geopolitical dimension too. Countries with limited domestic oil resources see pyrolysis as a way to reduce import dependence. Japan, which imports nearly all its crude oil, has been particularly interested in waste-to-energy technologies.

The trajectory for pyrolysis oil looks promising but not guaranteed. Technological improvements are making the process more efficient and cost-effective. New catalyst-free pyrolysis devices promise to simplify operations and reduce costs. Better sensors and process controls allow operators to handle more variable feedstocks and maintain consistent output quality.

Integration with existing industrial infrastructure is accelerating. More refineries are qualifying pyrolysis oil as an approved feedstock. Chemical manufacturers are building supply agreements with pyrolysis operators. This mainstream acceptance is critical for scaling beyond niche applications.

Policy will likely remain the wild card. Strong regulatory support, like extended producer responsibility schemes that make plastic manufacturers financially responsible for end-of-life disposal, could dramatically boost demand for pyrolysis services. Carbon pricing that reflects the true environmental cost of landfilling or incineration would also help.

The ultimate question is whether pyrolysis becomes a cornerstone of a circular plastics economy or a profitable but limited side business. Optimists envision a future where plastic waste routinely flows back into the supply chain, displacing virgin plastic production. Skeptics worry that pyrolysis is a complex, expensive band-aid on a system that needs fundamental redesign.

What's clear is that we can't recycle our way out of the plastic crisis with mechanical recycling alone. The majority of plastic waste isn't suitable for conventional recycling and will continue to accumulate unless we find alternatives. Pyrolysis offers one viable path, converting trash into a resource rather than a problem.

For professionals in sustainability, waste management, or chemical engineering, pyrolysis represents both opportunity and challenge. The technology works, the market is growing, and policy support is building. But success requires navigating feedstock variability, market volatility, regulatory complexity, and public skepticism.

The plastic waste we generate today doesn't have to be tomorrow's pollution. It can be tomorrow's chemical feedstock, if we're willing to transform how we think about trash. Pyrolysis oil isn't a silver bullet, but it might be a crucial piece of a much larger puzzle. And that puzzle is nothing less than figuring out how eight billion people can live on a finite planet without drowning in our own waste.

Ahuna Mons on dwarf planet Ceres is the solar system's only confirmed cryovolcano in the asteroid belt - a mountain made of ice and salt that erupted relatively recently. The discovery reveals that small worlds can retain subsurface oceans and geological activity far longer than expected, expanding the range of potentially habitable environments in our solar system.

Scientists discovered 24-hour protein rhythms in cells without DNA, revealing an ancient timekeeping mechanism that predates gene-based clocks by billions of years and exists across all life.

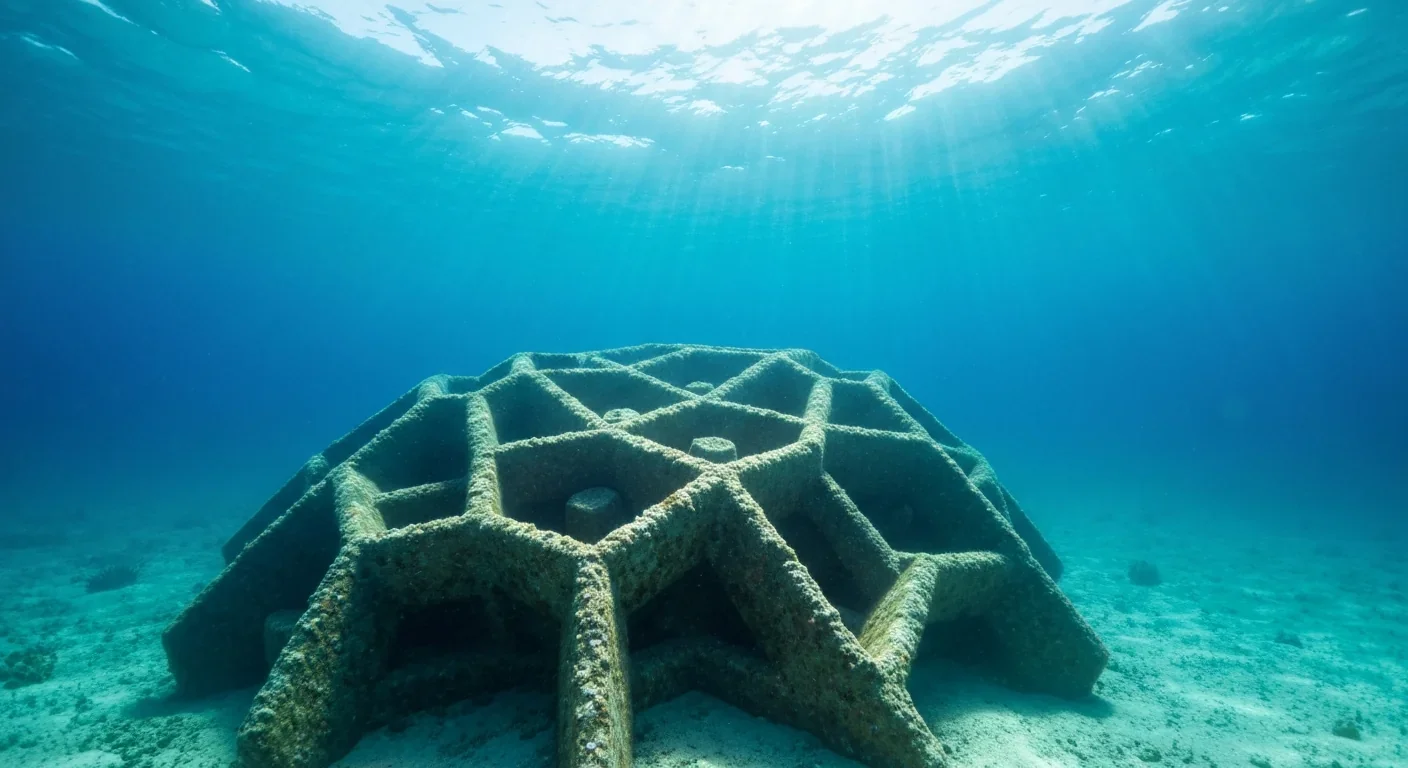

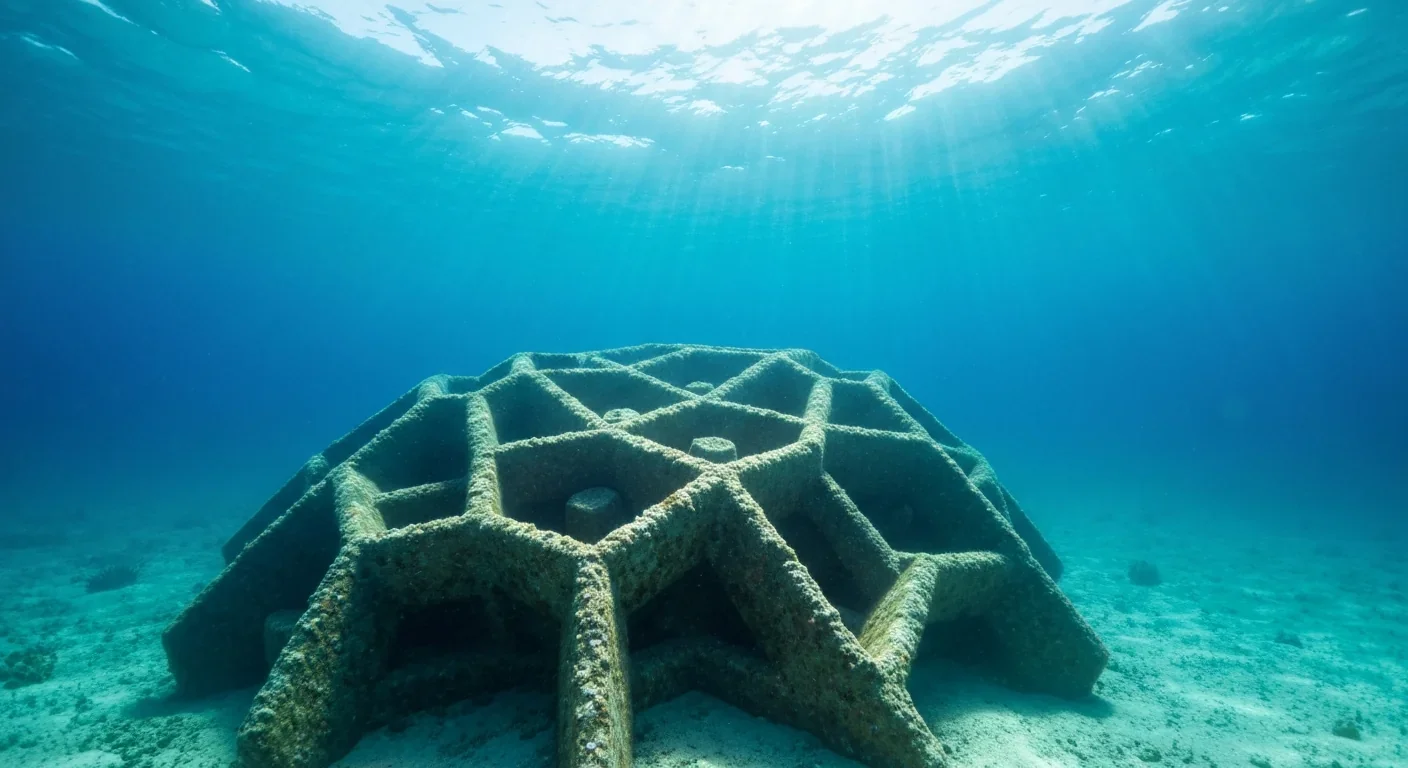

3D-printed coral reefs are being engineered with precise surface textures, material chemistry, and geometric complexity to optimize coral larvae settlement. While early projects show promise - with some designs achieving 80x higher settlement rates - scalability, cost, and the overriding challenge of climate change remain critical obstacles.

The minimal group paradigm shows humans discriminate based on meaningless group labels - like coin flips or shirt colors - revealing that tribalism is hardwired into our brains. Understanding this automatic bias is the first step toward managing it.

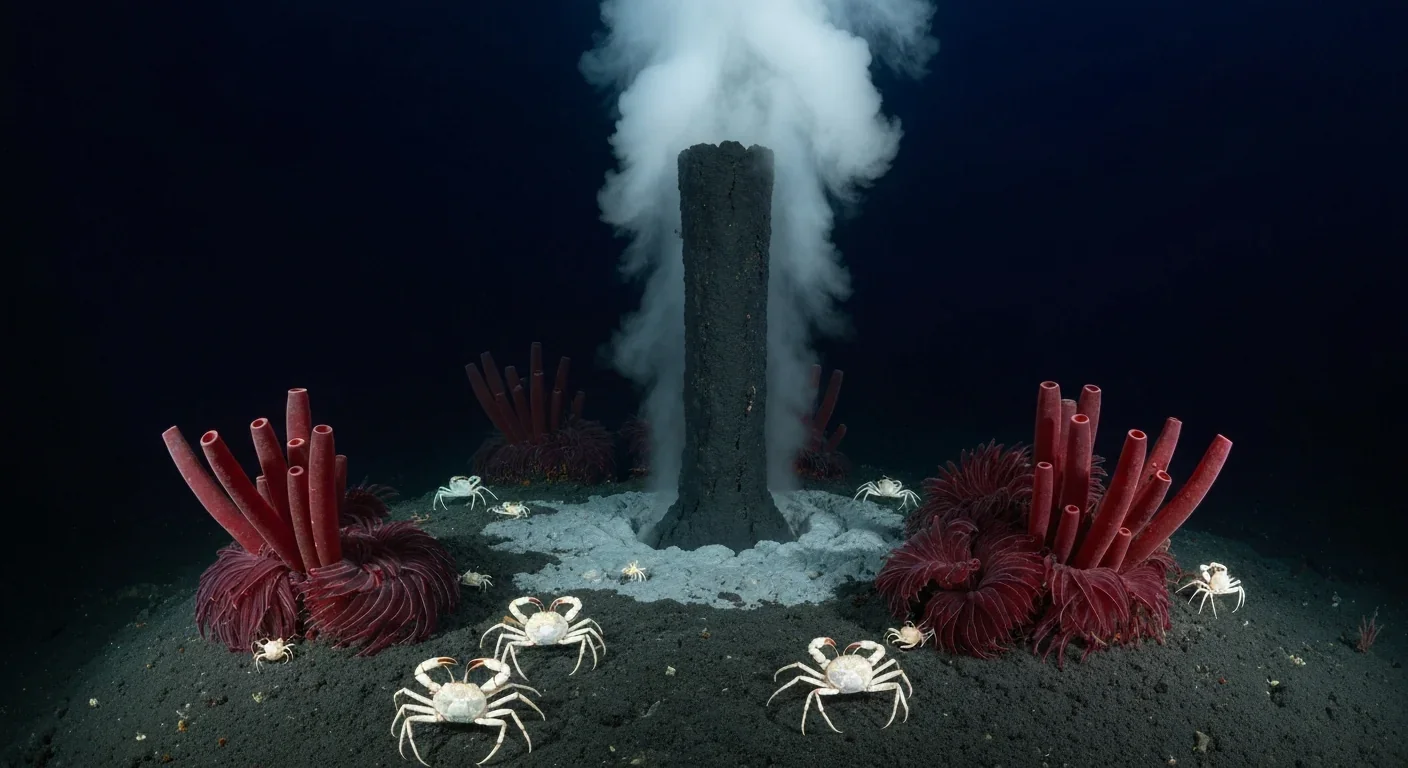

In 1977, scientists discovered thriving ecosystems around underwater volcanic vents powered by chemistry, not sunlight. These alien worlds host bizarre creatures and heat-loving microbes, revolutionizing our understanding of where life can exist on Earth and beyond.

Automated systems in housing - mortgage lending, tenant screening, appraisals, and insurance - systematically discriminate against communities of color by using proxy variables like ZIP codes and credit scores that encode historical racism. While the Fair Housing Act outlawed explicit redlining decades ago, machine learning models trained on biased data reproduce the same patterns at scale. Solutions exist - algorithmic auditing, fairness-aware design, regulatory reform - but require prioritizing equ...

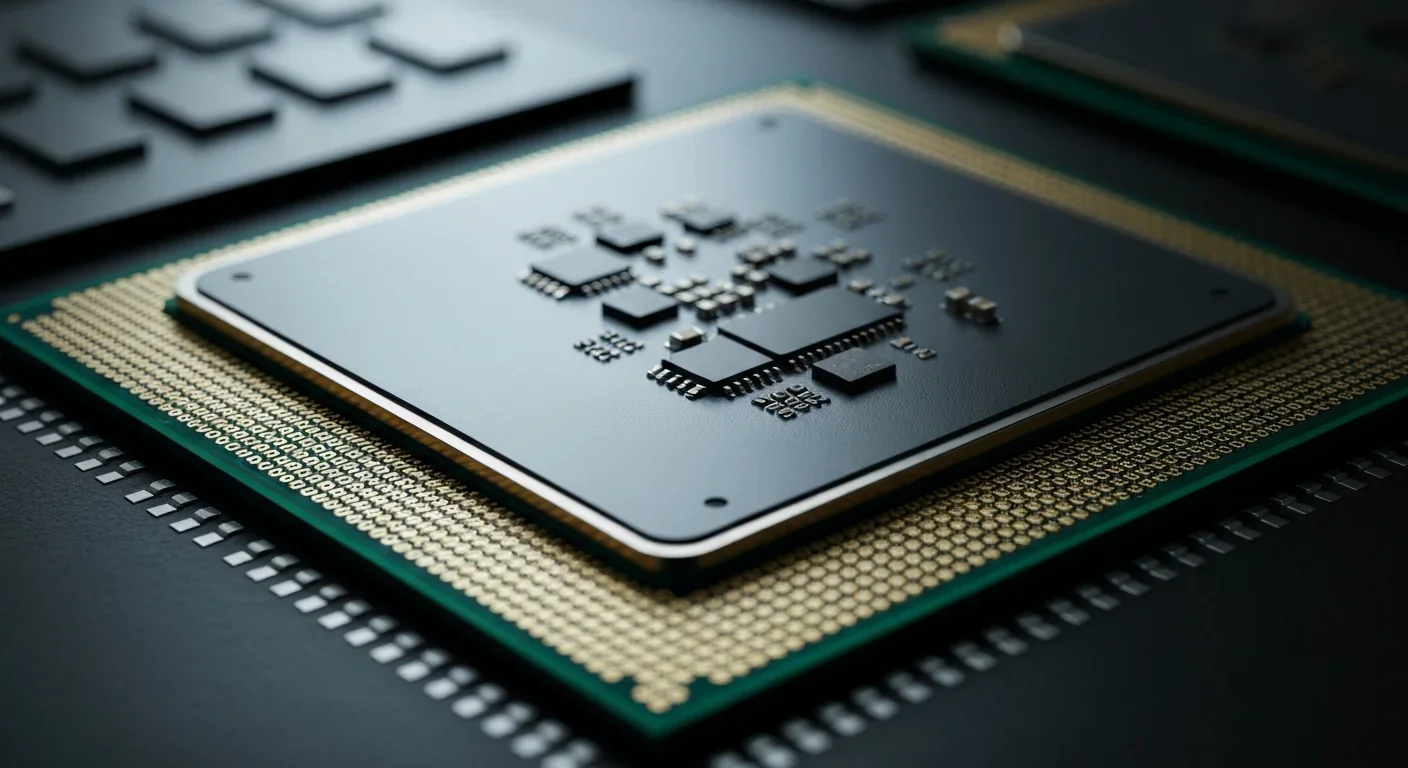

Cache coherence protocols like MESI and MOESI coordinate billions of operations per second to ensure data consistency across multi-core processors. Understanding these invisible hardware mechanisms helps developers write faster parallel code and avoid performance pitfalls.